American Eagle Outfitters, Inc. AEO is making waves in the market, riding high on its digital efforts and robust strategies such as the Real Power Real Growth Plan. The company’s stellar brand appeal and strong product demand have struck a chord with consumers. With confidence, the management proudly declares robust holiday results, fueling a bullish outlook for the fourth quarter of fiscal 2023, boasting record-breaking holiday sales and vigorous merchandise margins.

A Stellar Holiday Performance

The company reported an impressive 8% surge in fourth quarter-to-date revenues, until Saturday, Dec 30, 2023. American Eagle witnessed high-single-digit growth, while Aerie soared in the low teens, demonstrating across-the-board growth across its brands. Heading into 2024, management is optimistic about delivering substantial earnings growth and operational rate enhancement, driven by inventory and promotional discipline, expense control prioritization, and gains from profit-improvement initiatives.

Strategic Growth Initiatives

American Eagle’s Real Power Real Growth value-creation plan has been a cornerstone of the company’s sustained success, propelling profitability through real estate and inventory optimization, omnichannel and customer focus, and investments to enhance the supply chain. As part of this initiative, American Eagle is steadfast in growing the Aerie brand into new markets, fostering innovation, and expanding its customer base. The management is also committed to initiatives that will fuel growth and sustained profitability for the American Eagle brand.

Uplifted Brand Appeal

The Aerie brand has been on an upward trajectory, buoyed by robust demand in its core apparel, extension in activewear, strength in the OFFLINE brand, and resurging momentum in intimates. The strength in its core apparel collection, particularly in fleece, bottoms, and tops, has emerged as a prime growth driver. Additionally, its activewear extension, OFFLINE by Aerie, is thriving due to strong performance in tops, sports bras, active shorts, and fashion items. The management anticipates opening 25 stores during fiscal 2023.

Further Considerations

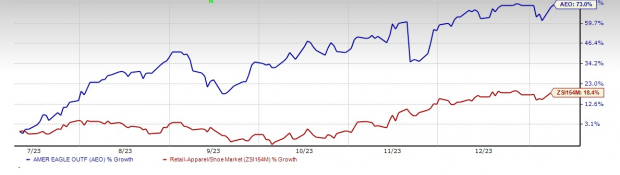

The company’s stock has witnessed a substantial 73% surge, outperforming the industry’s 18.4% growth over the last six months. The VGM Score of A further bolsters the strength of this current Zacks Rank #2 (Buy) company.