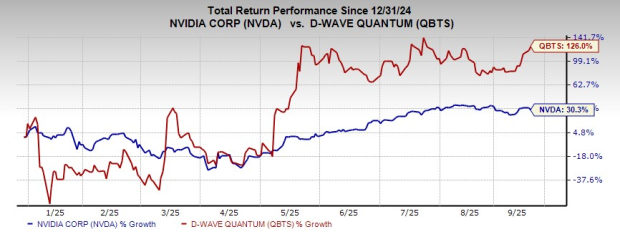

American Public Education, Inc. (APEI) has risen an astonishing 117.4% in the past three months, benefiting significantly from strong performances by the American Public University System (APUS), Hondros College of Nursing segment (HCN), and Graduate School. The company’s relentless focus on cost-saving measures and affordable tuition has propelled its meteoric rise, outperforming both the Zacks School industry’s 17.8% growth and the S&P 500 index’s 8% rally. Impressive earnings, consistently beating the Zacks Consensus Estimates, with an average surprise of 23.2% over the last three quarters, further underline APEI’s exceptional performance.

Investor sentiment remains bullish, as APEI has witnessed upward estimate revisions for its 2024 earnings, with analysts’ now projecting a significant year-over-year increase of 115.8%. Additionally, the company boasts a VGM Score of A supported by a Value and Growth Score of A, further solidifying its growth potential.

Image Source: Zacks Investment Research

So, what are the driving factors behind its current Zacks Rank #1 (Strong Buy)? Let’s delve into the details.

Strong Contribution From APUS & HCN

APEI has witnessed remarkable enrollment growth at APUS and HCN. In the third quarter of 2023, net course registrations at APUS surged by 8% year over year, including 12% growth in active-duty military enrollments and nearly 5% in the veteran’s channel. Equally impressive, HCN achieved a 17% year-over-year growth in enrollment for the 15th consecutive quarter.

The substantial revenue increments of 11% and 20% in APUS and HCN, respectively, were fueled by effective marketing strategies and successful enrollment initiatives. Furthermore, lucrative tuition and fee increases further bolstered their financial performance.

APUS and HCN’s success can be attributed to several factors, including the surge in military-related registrations, increased tuition for nonmilitary students, and strong demand for nursing programs in the market. These factors have been instrumental in propelling the overall success of both segments.

Margin Expansion Moves

APEI has been proactive in addressing cost pressure by implementing several strategic initiatives. Notably, the company’s initiatives to enhance marketing efficiency, right-size the cost structure, and execute headcount reductions have yielded approximately $15.5 million in annualized savings.

With a 570 basis points expansion in EBITDA margin year over year to 12% in the third quarter of 2023, APEI’s relentless focus on margin growth is expected to persist throughout 2023. These positive developments are a result of modest tuition increases, heightened marketing expenditure, and a relentless pursuit of cost optimization.

Strategic Initiatives & Affordability

APEI’s continuous efforts to improve enrollment trends and student persistence have been notable. The company’s emphasis on driving student persistence rate, offering competency-based education programs, and deploying geographical marketing tactics augur well for its long-term growth.

Additionally, APEI has stayed true to its founding principle of offering affordable tuition, ensuring that students are burdened with comparably less debt. Notably, APUS offers various tuition grants to support military students, resulting in significant savings. Both Rasmussen University and HCN also adhere to a similar philosophy of affordable education, ensuring their competitiveness in the market.

Focus on Nursing Programs

The U.S. healthcare sector is currently facing a severe talent shortage, and APEI’s RU segment, with 23 campuses, is dedicated to bridging this gap by training new nurses. The company’s unwavering commitment to its mission amid the healthcare crisis underscores its value as a strategic player in the industry.

Other Key Picks

Noteworthy top-ranked stocks in the same sector include Stride, Inc. (LRN), Virco Mfg. Corporation (VIRC), and JAKKS Pacific, Inc. (JAKK). Each of these companies boasts strong financial performance and favorable growth prospects within the industry.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.