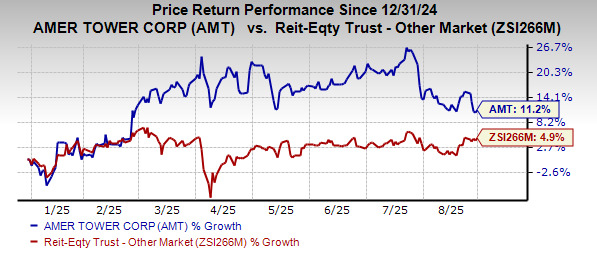

American Tower Corporation (AMT) shares have risen 11.2% year-to-date, outperforming the industry growth of 4.9%. The company is expected to benefit from increased investments by wireless carriers in 5G networks, driven by solid business fundamentals and a strong capital allocation strategy.

As of June 30, 2025, American Tower reported a net leverage ratio of 5.1 and total liquidity of $10.5 billion. Analysts project the Zacks Consensus Estimate for its 2025 adjusted funds from operations (FFO) per share to be $10.60, up by one cent over the past month.

Despite high customer concentration and concerns over increasing interest expenses, American Tower is maintaining a strong dividend strategy, having raised its annualized dividend by 8.26% over the past five years and growing it 14 times.