Exceeding Expectations: American Tower’s Q4

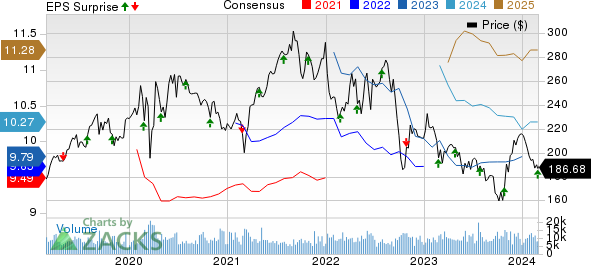

American Tower Corporation (AMT) reported a robust fourth-quarter performance, surpassing the Zacks Consensus Estimate for adjusted funds from operations (AFFO) per share. The company’s AFFO per share of $2.29 outpaced the estimated $2.18. Additionally, total revenues of $2.79 billion exceeded the Zacks Consensus Estimate of $2.73 billion.

Year-over-Year Growth

Despite a 2.1% dip in AFFO per share compared to the previous year, American Tower saw a 3% increase in revenues from the fourth quarter of 2022.

Steady Growth Continues in 2023

American Tower’s strong performance extended into 2023, with an AFFO of $9.87 per share, marking a 1.1% increase from the previous year. Total revenues also grew by 4% to $11.14 billion, outpacing the consensus estimate.

Robust Operating Revenues

In the fourth quarter, AMT’s Total Property revenues surged by 4.6%, reaching nearly $2.77 billion. The growth outpaced expectations, demonstrating the company’s solid operational performance.

Additionally, Data Centers revenues increased by 8.6% year over year to $215 million, slightly exceeding projected figures.

However, Services revenues experienced a 65% decline year over year, falling short of estimations.

Non-Financial Metrics Report

Despite minor deviations from projections, AMT showcased positive organic tenant billings growth in the United States, Canada, and internationally, driving a promising outlook for the company’s future.

Cash Flow Strength

American Tower generated $1.14 billion in cash from operating activities in the fourth quarter, showcasing resilience despite a slight year-over-year decline. Free cash flow also saw a notable increase of 17.7% from the previous year, reaching $611 million.

The company retained total liquidity of $9.6 billion as of December 31, 2023, providing a stable financial foundation for future endeavors.

Guidance for 2024

Looking ahead, American Tower anticipates continued growth with projections indicating a 1.3% increase in total property revenues and a 4.7% rise in AFFO per share.

The company’s adjusted EBITDA is expected to show marginal growth, reflecting a positive trajectory for the upcoming year.

Comparison with Other REITs

American Tower’s performance stands out among its peers, with companies like Lamar Advertising Company, Public Storage, and Welltower Inc. also reporting positive growth in adjusted funds from operations.

AMT’s steady growth trajectory and strong financial position position the company favorably within the real estate investment trust (REIT) sector.