Ameriprise Financial Reports Third-Quarter Earnings Amid Rising Expenses

Ameriprise Financial’s AMP third-quarter 2024 adjusted operating earnings were $8.83 per share, slightly below the Zacks Consensus Estimate of $8.91. This represents an increase of 15% compared to the same quarter last year. If we exclude severance expenses, adjusted earnings improved to $9.02 per share.

See the Zacks Earnings Calendar to stay ahead of market-making news.

The company faced challenges from rising expenses, but growth in revenue and increases in assets under management (AUM) and assets under administration (AUA) helped mitigate these issues.

On a GAAP basis, net income for the quarter was $511 million or $5.00 per share, down from $872 million or $8.14 per share a year ago. Analysts had anticipated a higher net income of $919.1 million.

Improved Adjusted Revenues, Higher Expenses

Ameriprise’s adjusted operating total net revenues rose to $4.35 billion, marking an 11% increase year over year. This figure surpassed the Zacks Consensus Estimate of $4.31 billion.

GAAP net revenues reached $4.4 billion, representing a 12% increase from the previous year.

Adjusted operating expenses climbed to $3.3 billion, an 11% increase compared to the prior year. The projected adjusted expenses had been $3.05 billion. When excluding severance and unlocking expenses, adjusted operating total net expenses were $3.19 billion.

Total AUM and AUA grew by 22% year over year to reach $1.51 trillion, fueled by strong client inflows and positive market performance. This figure exceeded our estimate of $1.41 trillion.

Share Repurchase Update

During the quarter, Ameriprise repurchased 1.3 million shares at a cost of $563 million.

Outlook for Ameriprise

Increased expenses, primarily driven by technology upgrades, are likely to continue impacting AMP’s net earnings. Nonetheless, the company remains well-positioned for significant revenue growth, supported by its strong AUM and ongoing business restructuring efforts.

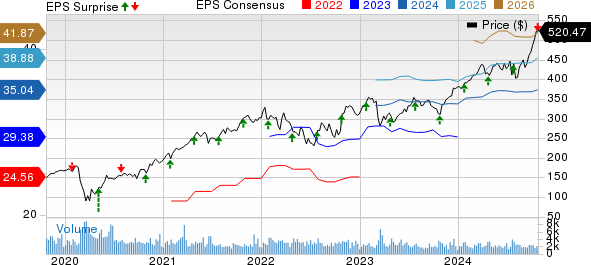

Ameriprise Financial, Inc. Price, Consensus, and EPS Surprise

Ameriprise Financial, Inc. price-consensus-eps-surprise-chart | Ameriprise Financial, Inc. Quote

Ameriprise currently holds a Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comparative Performance of AMP’s Competitors

BlackRock’s BLK reported adjusted earnings of $11.46 per share for the third quarter of 2024, significantly exceeding the Zacks Consensus Estimate of $10.34. This reflects a 5% increase from the same quarter last year.

BlackRock’s results benefitted from revenue growth and an increase in non-operating income, with AUM reaching $11.45 trillion thanks to strong net inflows and market appreciation. However, higher expenses presented challenges.

Invesco’s IVZ third-quarter adjusted earnings of 44 cents per share matched the Zacks Consensus Estimate and represented a 25.7% increase from the previous year.

The improvement in Invesco’s earnings was driven by a decrease in adjusted expenses and increases in adjusted net revenues, along with growth in AUM from solid inflows.

5 Stocks Set to Double

These stocks have been chosen by Zacks experts as top candidates to achieve +100% growth in 2024. Although not every selection will succeed, past picks have shown remarkable returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently overlooked by Wall Street, presenting a valuable opportunity for early investment.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.