Amkor Technology Prepares for Third-Quarter Earnings Release

Amkor Technology (AMKR) is set to release its third-quarter 2024 results after the market closes on October 28.

The company expects revenue between $1.785 billion and $1.885 billion, with a mid-point estimate of $1.835 billion. This forecast represents a sequential growth of 22% to 29%. The Zacks Consensus Estimate for revenue stands at $1.83 billion, indicating a slight increase of 0.6% compared to the previous year’s revenue of $1.82 billion.

Amkor anticipates earnings per share (EPS) to fall between 42 and 56 cents. Currently, the Zacks Consensus Estimate for EPS is 50 cents, a figure that has remained unchanged over the last 60 days. This represents a 7.4% decline from last year’s reported EPS.

Notably, Amkor has exceeded the Zacks Consensus Estimate in each of the previous four quarters, with an average surprise factor of 45.4%.

Explore the latest EPS estimates and surprises on Zacks Earnings Calendar.

Key Factors Influencing Performance

Amkor’s performance in the third quarter is likely driven by the launch of new products, including advanced system-in-package (SiP) technology and 2.5D technology. The rising demand for Internet of Things (IoT) wearables could have significantly boosted sales in the Consumer market during this period.

Additionally, strong performance in artificial intelligence (AI), along with growing demand in high-performance computing and ARM-based personal computers, is expected to enhance revenues from the Computing market. Furthermore, advanced packaging, aimed at the seasonal launch of premium smartphones, likely supported growth in the Communications market.

Amkor’s robust long-term partnerships and expanding global presence are also anticipated to positively impact its revenue in this quarter.

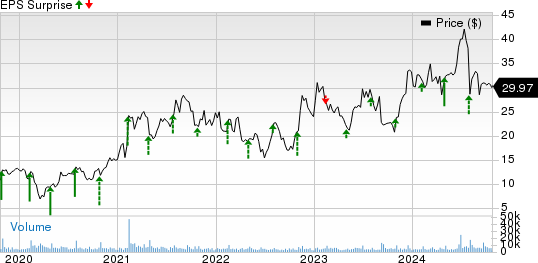

Amkor Technology, Inc. Price and EPS Surprise

Amkor Technology, Inc. price-eps-surprise | Amkor Technology, Inc. Quote

A recent partnership between Amkor and Infineon Technologies to establish a dedicated packaging and test center at Amkor’s Porto manufacturing site is noteworthy. This long-term agreement strengthens their collaboration and enhances their outsourced semiconductor assembly and test model.

However, the ongoing challenges in the Automotive and Industrial markets may have overshadowed revenue gains in other sectors. The automotive sector, in particular, has been affected by inventory corrections, leading to a reported 2% decline in revenues from this segment in the previous quarter.

Earnings Prediction Insights

According to Zacks’ model, a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) increases the likelihood of an earnings beat. Currently, AMKR holds an Earnings ESP of 0.00% and a Zacks Rank of #3, indicating average expectations for performance.

Stocks to Watch

Here are some stocks that appear poised to exceed earnings expectations in this reporting cycle:

Arista Networks (ANET) reports an Earnings ESP of +0.96% and has a Zacks Rank of #2. The company shares have climbed 68.4% this year and is scheduled to release its third-quarter 2024 results on November 7. The Zacks Consensus Estimate for ANET’s earnings is projected at $2.08 per share, reflecting a 13.7% increase from last year’s results.

Onto Innovation (ONTO) shows an Earnings ESP of +2.74% and also carries a Zacks Rank of #2. The company’s shares increased by 34.7% year to date and are set to announce their third-quarter 2024 results on October 31. The consensus earnings estimate for ONTO stands at $1.31 per share, representing an improvement of 36.5% from the same period last year.

Meta Platforms (META) has an Earnings ESP of +2.83%, with a Zacks Rank of #2. META shares have surged 64.5% in 2023 and are due to report third-quarter 2024 results on October 30. The Zacks Consensus Estimate for META’s earnings is $5.17 per share, indicating an increase of 17.8% year-over-year.

Investment Opportunities Highlighted by Zacks

Experts have identified five stocks with significant potential for high returns in the upcoming months. Among these, Zacks’ Director of Research, Sheraz Mian, emphasizes one stock that is particularly well-positioned for substantial gains.

This standout stock is associated with a rapidly growing customer base, currently exceeding 50 million, and is recognized for its innovative financial solutions. While not all selections are guaranteed winners, this pick aims to build on previous Zacks success stories, like Nano-X Imaging, which rose by +129.6% within a relatively short time frame.

Free: See Our Top Stock And 4 Runners Up

For the latest recommendations from Zacks Investment Research, download the list of 5 Stocks Set to Double.

Amkor Technology, Inc. (AMKR): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Onto Innovation Inc. (ONTO): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.