Amphenol Corporation Reports Strong Q1 Earnings and Market Outperformance

Amphenol Corporation (APH), located in Wallingford, Connecticut, specializes in the design, manufacture, and marketing of electrical, electronic, and fiber optic connectors both in the U.S. and internationally, including China. With a market capitalization of $97.8 billion, the company operates through three primary segments: Harsh Environment Solutions, Communications Solutions, and Interconnect and Sensor Systems.

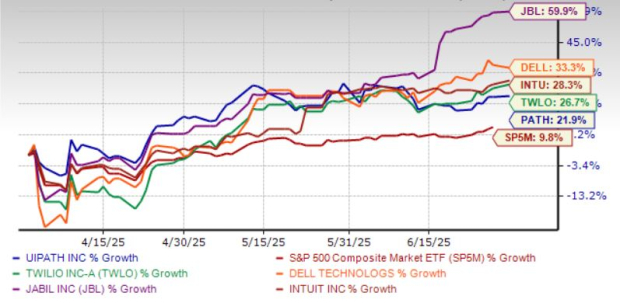

Over the last year, APH has significantly outperformed the broader market. Its stock prices have increased by 26.8% over the past 52 weeks and 16.5% year-to-date (YTD). In comparison, the S&P 500 Index ($SPX) experienced gains of only 8.6% in the past year and a drop of 3.8% in 2025.

Narrowing focus, APH has also surpassed the Technology Select Sector SPDR Fund’s (XLK) performance, which returned only 6.3% over the past year and faced a 6.4% decline YTD.

The company saw its shares rise by 8.2% following the announcement of its Q1 results on April 23. Net sales for the quarter skyrocketed by 47.7% year-over-year, reaching a record $4.8 billion and exceeding market expectations. Additionally, the adjusted operating margin improved from 21.3% in the previous year to 23.5%, contributing to a remarkable 65% increase in adjusted operating income, totaling $1.1 billion. Amphenol’s adjusted earnings per share (EPS) also jumped by 57.5% compared to the prior year, reaching $0.63 and outperforming forecasts by 21.2%.

Looking ahead to fiscal year 2025, which ends in December, analysts predict an impressive 38.6% year-over-year growth in adjusted earnings, estimating EPS at $2.62. Furthermore, Amphenol has demonstrated a solid earnings surprise history, having exceeded bottom-line expectations in each of the last four quarters.

The consensus rating for APH stands at “Strong Buy.” Among the 16 analysts tracking the stock, there are 12 “Strong Buy” ratings and four “Holds.”

This outlook is notably stronger than it was a month ago, when only 11 analysts recommended “Strong Buy.” On April 24, Goldman Sachs (GS) analyst Mark Delaney reaffirmed a “Buy” rating for APH, raising the price target from $72 to $80.

As of now, APH’s average price target of $85.07 indicates a 5.2% increase from current levels, while the highest target, set at $102, suggests an impressive upside potential of 26.1%.

On the date of publication, Aditya Sarawgi did not hold any positions, directly or indirectly, in any securities mentioned in this article. All information and data presented here are for informational purposes only. Please view the Barchart Disclosure Policy here.

The views expressed in this article solely reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.