Amtech Systems Faces Challenges Amid Industry Headwinds and Restructuring

Amtech Systems (ASYS) shares have plummeted 31.2% this year. This decline significantly outpaces the broader Zacks Computer and Technology sector, which dropped 14.4%, and the Zacks Semiconductor – General industry, which fell by 17.3%.

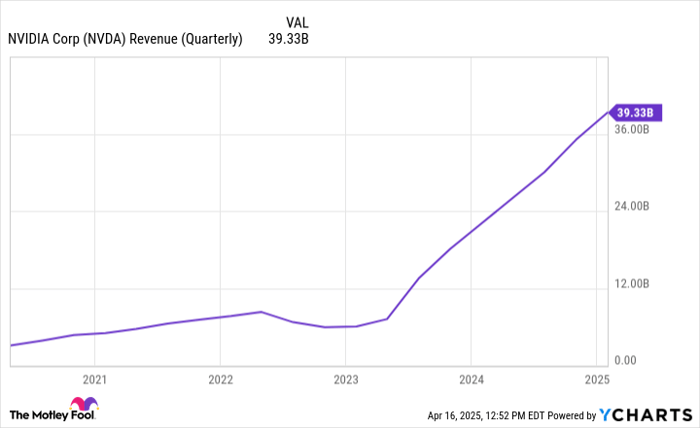

In comparison to its competitors like NVIDIA (NVDA), STMicroelectronics (STM), and Texas Instruments (TXN), ASYS has also lagged behind. Over the same period, shares of NVIDIA, STMicroelectronics, and Texas Instruments saw declines of 17.4%, 18.1%, and 21.3%, respectively.

Amtech’s share price downturn reflects investor apprehensions regarding its revised outlook for the second quarter of fiscal 2025. The company is experiencing challenges in vital market segments, especially in industrial equipment and automotive sectors, where demand for equipment and consumables remains subdued.

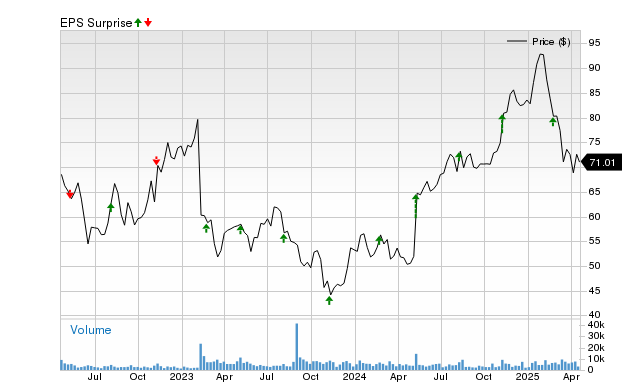

Amtech Systems, Inc. Price and Consensus

Amtech Systems, Inc. price-consensus-chart | Amtech Systems, Inc. Quote

ASYS Cuts Q2 Forecast Amid Industry Slowdown

Recently, Amtech provided a troubling update concerning its fiscal second-quarter guidance, disclosing notable operational and financial challenges. ASYS revised its revenue forecast down from $21-$23 million to $15-$16 million. This adjustment is linked to a customer dispute within the Thermal Processing Solutions segment, which triggered a $4.9 million shipment delay, and persistent weakening demand in the mature-node semiconductor sector, particularly in silicon carbide applications.

As a result, ASYS expects to report a nominally negative adjusted EBITDA for the upcoming quarter, reversing its earlier expectations of a nominally positive outcome.

Despite these setbacks, Amtech has shown resilience through restructuring efforts and a renewed focus on advanced packaging. This strategy has bolstered capital equipment demand and contributed to improved profitability and financial stability. The demand for ASYS reflow equipment, especially in leading-edge applications like AI infrastructure, continues to grow.

Restructuring and Cost Efficiency Drive Amtech’s Growth

Amtech has made significant strides in restructuring its operations to enhance cost efficiency and adapt to changing market conditions. So far, these efforts have yielded considerable results, achieving over $8 million in annualized cost savings. Projections suggest this could reach $9 million by the end of the second quarter of fiscal 2025. A pivotal part of this transformation involves adopting a semi-fabless manufacturing model, effectively reducing fixed costs and enhancing operational leverage.

In light of rising inflation, Amtech has proactively adjusted pricing strategies over recent quarters to improve product margins. By the end of the second quarter, the company expects to have cleared a considerable portion of its low-priced, lower-margin backlog, which should positively impact profitability. Moving forward, Amtech plans to maintain its pricing strategy with an emphasis on sustaining robust margins and ensuring long-term profitability amidst a fluctuating market environment.

Strong Demand in Advanced Packaging Enhances ASYS’ Outlook

Amtech is experiencing a marked increase in demand for advanced packaging, largely driven by the rapid growth of AI infrastructure. The long-term outlook for this segment remains promising as momentum in AI and high-performance computing promotes capital equipment investments. Amtech’s primary customers, particularly OSAT, are increasingly focused on packaging chipsets for AI data centers, with the growth of AI-enabled hardware at the edge further driving the need for innovative packaging solutions.

Recognizing advanced packaging as a crucial growth factor, especially within the expanding AI infrastructure market, Amtech observed rising demand for its reflow equipment related to AI applications in the first quarter of fiscal 2025. This increasing interest is expected to serve as a critical growth catalyst.

Conclusion

While ASYS confronts immediate challenges stemming from weak demand in industrial and automotive sectors, its strong position in the rapidly growing AI-driven advanced packaging market presents a notable opportunity for recovery. Operational enhancements and a focus on higher-margin initiatives reinforce its positive outlook.

Currently, Amtech holds a Zacks Rank #3 (Hold). For a full list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

5 Stocks Set to Double

These stocks were selected by Zacks experts as their top picks, expected to gain +100% or more in 2024. While not every selection may succeed, previous recommendations have achieved gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this report are under the radar for Wall Street, providing an excellent opportunity to invest early.

Today, discover These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click to access this free report

Texas Instruments Incorporated (TXN): Free Stock Analysis report

STMicroelectronics N.V. (STM): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Amtech Systems, Inc. (ASYS): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.