“`html

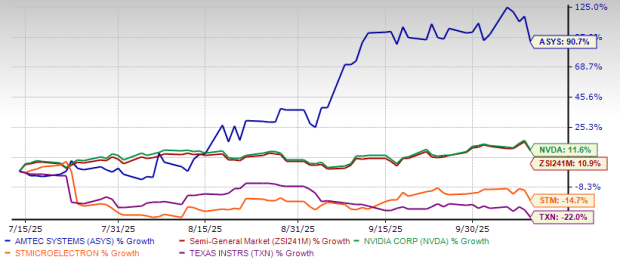

Amtech Systems, Inc. (ASYS) shares have surged 90.7% over the past three months, significantly outperforming the Zacks Semiconductor – General industry, which rose by 10.9%. In comparison, leading peers like NVIDIA (NVDA) gained 11.6%, while STMicroelectronics (STM) and Texas Instruments (TXN) saw declines of 14.7% and 22%, respectively.

In fiscal Q3 2025, Amtech recorded revenues of $19.6 million, down 27% year-over-year, primarily due to weak demand in the mature node semiconductor market. However, the company reported sales of AI-related equipment grew fivefold year-over-year, representing about 25% of its Thermal Processing Solutions revenues. Looking forward, Amtech projects Q4 2025 revenues between $17-$19 million, bolstered by strong demand in advanced packaging, expected to reach $89.89 billion by 2030, growing at a CAGR of 11.73%.

Moreover, Amtech’s forward 12-month price-to-sales (P/S) ratio stands at 1.58X, markedly lower than the industry average of 14.81X and competitors NVIDIA (17.83X), STM (1.91X), and TXN (8.28X). Despite challenges, the company remains positioned for growth in advanced packaging while facing headwinds in its mature node segments.

“`