Nvidia: Strong Earnings Potential Amid Market Uncertainty

Nvidia (NASDAQ: NVDA) has consistently outperformed analyst expectations, beating estimates in 9 out of the last 10 quarters. According to Barchart data, while the stock often rises following an earnings beat, it has experienced declines in some instances. This suggests that an earnings beat, while likely to boost the stock price, does not guarantee it.

Given the current market and trade uncertainties, analysts anticipate a weak earnings announcement next month. Interestingly, there are strong indicators that Nvidia might outperform these expectations. The stock’s decline of over 30% this year could also create opportunities for a significant valuation increase if results surprise to the upside.

Key Factors Supporting Nvidia’s Earnings Outlook

Nvidia has seen its revenue growth estimates reduced significantly in recent months, primarily due to geopolitical tensions impacting supply chains, particularly concerning tariffs. Around one-third of the company’s sales last year were linked to China through direct sales or related exports. Heightened tensions between the U.S. and China could complicate these transactions further.

However, strong demand from data centers remains a crucial driver for Nvidia. In the last quarter, the company reported a remarkable 93% year-over-year growth in its data center segment. Management believes this growth will continue for years, with projected industry capital expenditures in this area being pushed forward to an anticipated $1 trillion by 2030.

Besides strong demand, Nvidia’s share buyback program may enhance earnings. Launched last August, the $50 billion buyback has already seen approximately $33.7 billion utilized, leaving $16.3 billion for future repurchases. This program has positively impacted earnings per share, and aggressive buybacks could lead to better-than-expected results by reducing the number of outstanding shares.

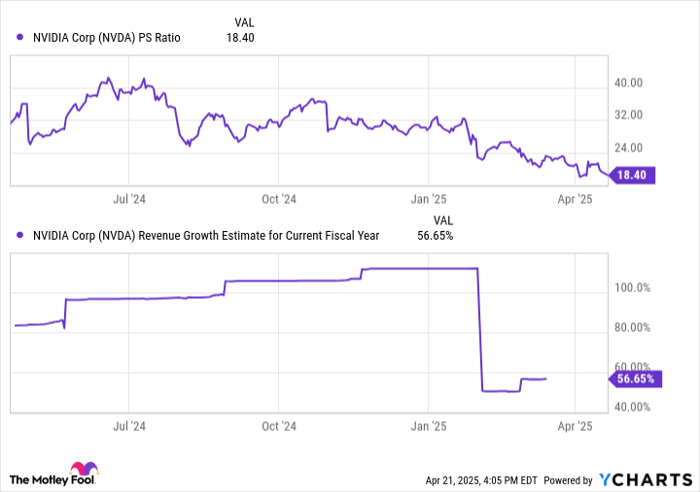

NVDA PS Ratio data by YCharts

Investment Considerations Ahead of Earnings

Investing in Nvidia shares requires a long-term perspective, as predicting short-term quarterly performance can be challenging. Historical trends show that even when the company exceeds earnings expectations, the stock may still decline. Thus, potential investors should consider the broader growth outlook rather than just short-term results.

Nvidia’s shares remain at 18.4 times sales, which may seem high, but given its robust growth potential, this valuation may be seen as a bargain in the coming years. Looking ahead, it seems likely that Nvidia will beat earnings estimates next month, but patient investors should focus on the long-term trajectory rather than immediate results. Weak earnings could even provide a buying opportunity.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.