Cisco Systems: Key Insights Ahead of Q1 Fiscal 2025 Earnings

Cisco Systems CSCO is preparing to unveil its first-quarter fiscal 2025 results on November 13.

For this quarter, the company projects revenues between $13.65 billion and $13.85 billion. Additionally, non-GAAP earnings are estimated to fall between 86 and 88 cents per share.

The Zacks Consensus Estimate anticipates revenues of $13.76 billion, reflecting a decrease of 6.17% compared to the same quarter last year. The earnings consensus has remained unchanged at 87 cents per share over the last month, indicating a significant year-over-year decline of 21.62%.

Notably, CSCO has outperformed the Zacks Consensus Estimate consistently over the previous four quarters, with an average earnings surprise of 4.93%.

Cisco Systems, Inc. Price and EPS Surprise

Cisco Systems, Inc. price-eps-surprise | Cisco Systems, Inc. Quote

Stay updated with the latest EPS estimates and surprises on Zacks Earnings Calendar.

Let’s explore what to expect before the upcoming earnings announcement.

Current Outlook for CSCO’s Q1 Earnings

Cisco is facing challenges due to weak networking sales, which stem from low demand among telecommunications and cable service providers coupled with intense competition. Ongoing inventory backlogs among customers have further hampered growth.

For the fourth quarter of fiscal 2024, Cisco’s revenues were reported at $13.64 billion, marking a 10.3% drop from the previous year. This decline was largely driven by a 15.4% decrease in product revenues, which contributed to 72.3% of total revenues.

The Zacks Consensus Estimate for networking revenues in the current fiscal first quarter is set at $6.909 billion, indicating a year-over-year reduction of 21.7%.

Collaboration revenues are expected to hit approximately $1.065 billion, reflecting a 4.7% year-over-year decline.

On a positive note, Cisco is experiencing growth in its security segment, fueled by strong demand for its offerings such as XDR, Secure Access, and Multicloud Defense suites. The Zacks Consensus Estimate for security revenues in this fiscal first quarter stands at $1.816 billion.

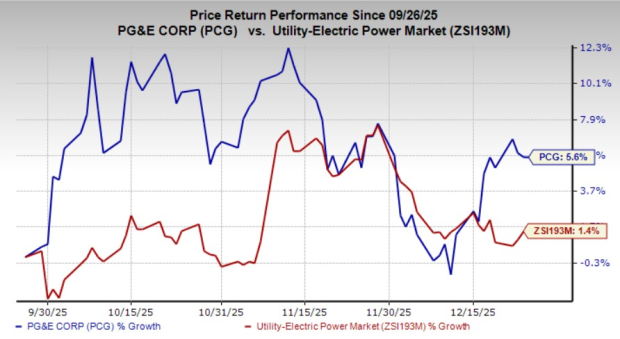

CSCO Stock Performance Compared to Sector

Cisco’s stock has risen by 14.9% year-to-date (YTD), underperforming the Zacks Computer & Technology sector’s increase of 30.4%, though it has outperformed the Zacks Computer Networking industry’s return of 14.2%.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

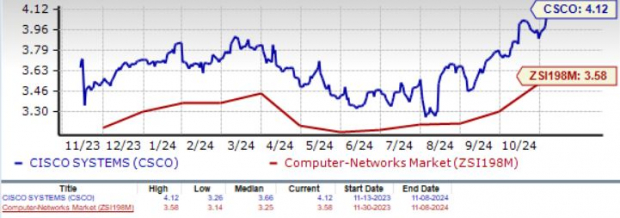

Despite the gains, Cisco stock is not considered inexpensive, with a Value Score of C indicating a potentially overvalued status at this time. The forward 12-month Price/Sales ratio for CSCO stands at 4.12, which is above the industry average of 3.58.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Cisco’s Growth Potential in AI and Security

The rise in AI-related workloads presents a significant opportunity for Cisco, supported by its innovative product range. The potential growth market is estimated at $950 billion, with existing markets expected to grow at a CAGR of 6% and emerging markets projected to increase by 16% from 2025 to 2027.

Cisco’s considerable investments in AI, cloud services, and cybersecurity have yielded over $1 billion in AI orders from major suppliers, along with an equivalent amount anticipated for fiscal 2025.

In cybersecurity, the company enjoys success with its XDR and Secure Access solutions. The current market is expected to experience a CAGR of 8%, while expansion markets may see a CAGR of 14% from 2025 to 2027. The recent acquisition of Splunk is anticipated to enhance Cisco’s prospects in this sector, particularly within addressable markets worth $118 billion.

In terms of infrastructure, Cisco holds an addressable market valued at $221 billion. The ongoing digital transformation and adoption of AI across businesses indicate a favorable outlook for Cisco’s products.

As demand in the networking sector begins to recover, Cisco’s diverse offerings in switching, routing, security, and observability should help customers automate operations through innovations like AI-driven robotics.

Strategic Partnerships Fueling Growth

Cisco boasts a strong lineup of partnerships, including prominent companies like Meta Platforms META, Microsoft, NVIDIA NVDA, Lenovo, and AT&T T.

The collaboration with NVIDIA has led to the creation of the Cisco Nexus HyperFabric AI cluster solution, designed to optimize generative AI workloads.

With AT&T, Cisco aims to deliver a streamlined digital purchasing experience for businesses, featuring 5G Fixed Wireless Access solutions through the Meraki MG52 and MG52E gateways.

Additionally, Cisco’s Silicon One technology is gaining traction, with Meta set to implement the Cisco 8501 system, which integrates cutting-edge hardware with Cisco’s advanced design.

Two new solutions based on Cisco’s Silicon One G200 will be launched, geared towards enhancing AI and machine learning in enterprise data centers and hyperscalers.

Conclusion

While Cisco may confront short-term hurdles stemming from sluggish networking sales, its expanding portfolio, robust cybersecurity offerings, and strategic partnerships position the company well for potential rebounds in fiscal 2025.

Cisco currently carries a Zacks Rank #3 (Hold). For more analysis, you can explore today’s Zacks #1 Rank (Strong Buy) stocks here.

Discover Top Clean Energy Stocks with Significant Potential

Energy is essential to our economy, driving a multi-trillion-dollar industry with many successful companies.

Modern technology is enabling clean energy sources to rival traditional fossil fuels. Massive investments are being allocated to clean energy projects, spanning solar power to hydrogen fuel cells.

Investing in emerging leaders in this field could offer exciting opportunities for your portfolio. Download “Nuclear to Solar: 5 Stocks Powering the Future” to see Zacks’ top picks for free today.

For the latest recommendations from Zacks Investment Research, download “5 Stocks Set to Double” at no charge.

AT&T Inc. (T) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.