Global Electric Vehicle Battery Capacity Reaches New Heights Amid Market Shifts

From January to October, the world saw a total of 674.6 GWh of new battery power, according to Toronto’s Adamas Intelligence, a firm specializing in EV supply chain research.

Increasing Popularity of Hybrid Vehicles

The surge in electric vehicle (EV) adoption coincides with a growing preference for hybrid vehicles, which typically contain smaller batteries. This trend reflects a noticeable shift in consumer choice.

This year, plug-in hybrid vehicles (PHEVs) have seen a staggering 71% increase in battery capacity compared to a modest 17% growth for fully electric cars. The average battery capacity of PHEVs has also risen, now averaging 23 kWh—over a third the capacity of a full EV battery.

Extended range electric vehicles (EREVs), a subtype of PHEVs, rely on a combustion engine primarily to recharge the battery. These vehicles boast an average battery capacity of 39 kWh, which is greater than that of many sub-compact and small cars.

In fact, EREV capacity and sales have more than doubled in 2024. Without the PHEV segment’s success, headlines about a downturn in the EV market would have been even more prominent.

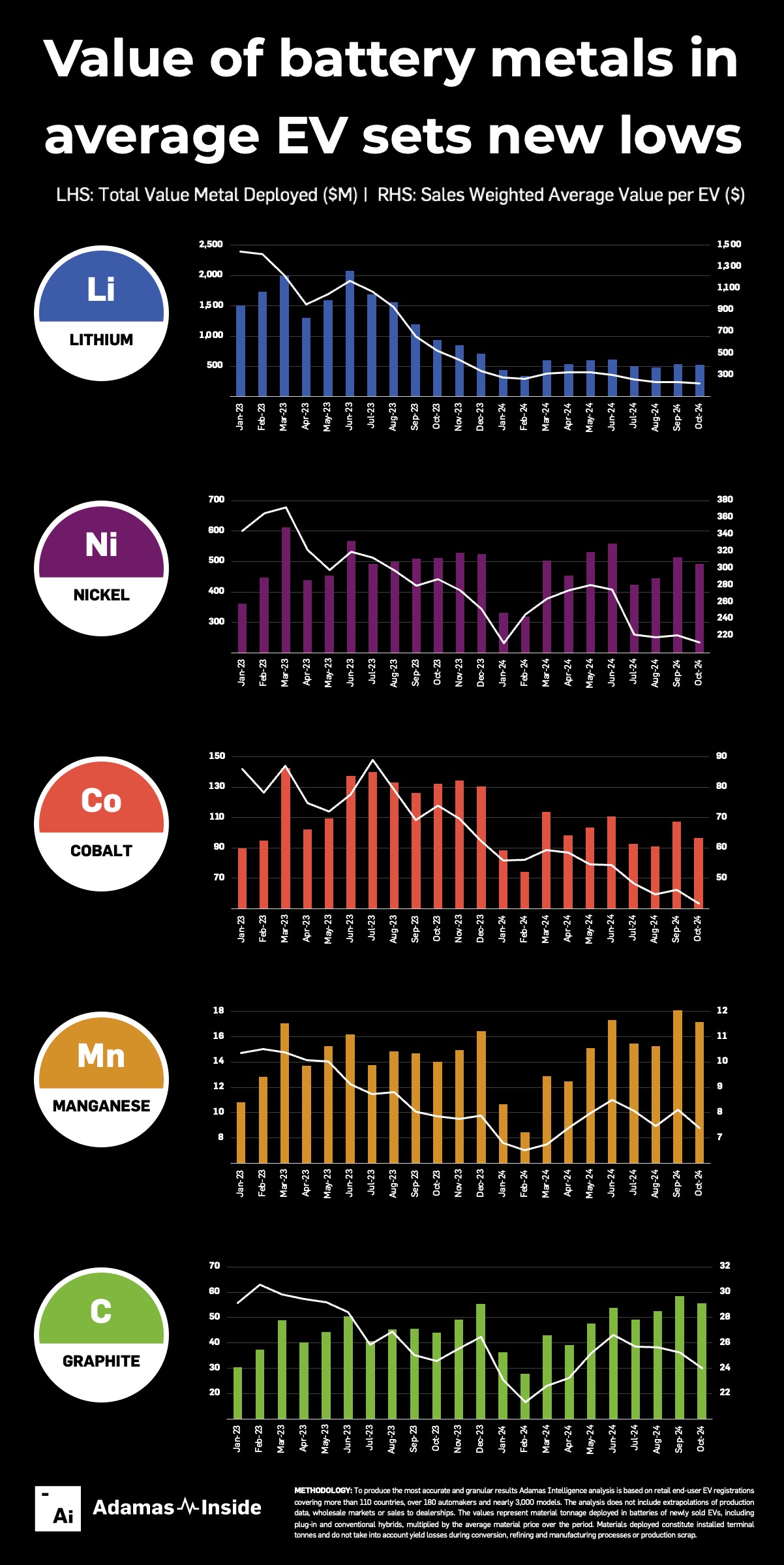

Challenges for Battery Material Suppliers

Conversely, miners supplying raw materials for the EV battery sector are facing negative trends. Data analyzed from over 110 countries indicates that the average monthly value of lithium, nickel, cobalt, manganese, and graphite in standard EV batteries continues to decline.

As prices for natural and synthetic graphite, lithium carbonate and hydroxide, and nickel, cobalt, and manganese sulfate fall, the average raw materials cost for an EV has dropped to $510. This marks a significant decline from $918 in October 2023, and a peak of over $1,900 in early 2023, according to Adamas Intelligence.

Specifically, the value of lithium has plummeted 74% this year, averaging $276 per EV for the first ten months. In October alone, this figure sank to a record low of $212, compared to $1,444 per EV at the start of 2023.

Cobalt’s value is now just under $42, marking a 34% decrease from October 2023, while manganese has also suffered in the raw materials market, averaging just over $7 per battery.

On the other hand, the price of graphite—used in anode materials—has remained relatively stable, sitting just under $26 per average EV. However, this average is still 13% lower than in 2023.

The Shift in Battery Chemistry

Nickel, a critical component for many EV batteries, has seen its average value drop by 25%. Notably, lithium iron phosphate (LFP) battery chemistries have captured a larger share of the market, representing 44% of global capacity deployed in GWh as of October 2024. This is an increase from the 33% share reported last year, suggesting a significant shift away from high-nickel cathodes.

The rise in LFP batteries contrasts with the ongoing popularity of nickel-based NCM batteries in PHEVs, where the energy density of nickel offers advantages given the additional weight of these vehicles.

For an in-depth analysis of the battery metals market, refer to the December issue of Northern Miner in print and digital formats.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.