Analysts See Significant Upside in iShares Morningstar Value ETF

In our review of exchange-traded funds (ETFs), we analyzed the underlying holdings of the iShares Morningstar Value ETF (Symbol: ILCV). By comparing each holding’s trading price to the average 12-month analyst target price, we’ve calculated a weighted average implied analyst target price for the ETF itself. For ILCV, this target price stands at $90.53 per unit.

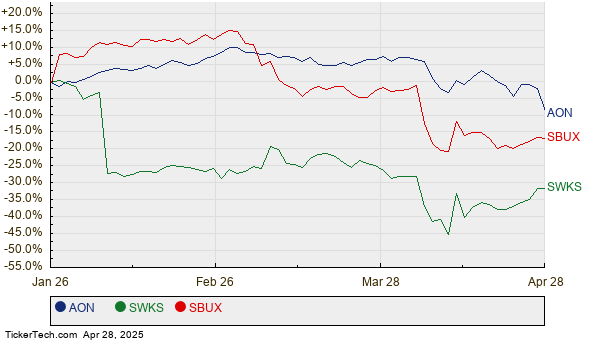

Currently trading at approximately $78.08 per unit, this indicates a potential upside of 15.93% based on analysts’ expectations for the ETF’s underlying assets. Notably, three underlying holdings exhibit strong upside potential relative to their analyst target prices: Aon plc (Symbol: AON), Skyworks Solutions Inc (Symbol: SWKS), and Starbucks Corp. (Symbol: SBUX). Aon, priced at $335.85 per share, has an average target price of $405.31, suggesting a 20.68% increase. Skyworks Solutions shows a 19.23% increase potential from its recent share price of $61.52, aiming for an average target of $73.35. Likewise, analysts project Starbucks’ target at $99.87, representing a 19.16% rise from its current price of $83.81.

Below is a twelve-month price history chart comparing the stock performance of AON, SWKS, and SBUX:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar Value ETF | ILCV | $78.08 | $90.53 | 15.93% |

| Aon plc | AON | $335.85 | $405.31 | 20.68% |

| Skyworks Solutions Inc | SWKS | $61.52 | $73.35 | 19.23% |

| Starbucks Corp. | SBUX | $83.81 | $99.87 | 19.16% |

Investors may wonder whether analysts’ targets are realistic or overly optimistic. Are these forecasts warranted based on recent company and industry developments, or do they reflect outdated expectations? A price target that is significantly higher than a stock’s current trading price may signal optimism but may also lead to potential downgrades if market conditions change. These considerations warrant further examination by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Cheap Technology Shares

• NCBS shares outstanding history

• Funds Holding ISCG

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.