By Jesús Aguado

MADRID, March 25 (Reuters) – As BBVA’s stock price skyrockets, the gap between it and its longstanding rival, Santander, is rapidly shrinking. The tables have turned, illustrating a remarkable divergence in fortunes between the two Spanish banking giants that may not be a long-standing trend.

Both institutions have deep roots dating back to 1857 and hail from the neighboring northern cities of Spain. Historically, Santander SAN.MC has been the undisputed champion in Spain, boasting assets more than double those of BBVA and a significantly larger market capitalization until quite recently.

A Changing Landscape

However, the gap that was once a substantial 20 billion euros ($22 billion) three years ago now stands at around 5.5 billion euros, sparking discussions about the efficacy of each bank’s strategic decisions. Market dynamics show a preference for banks that share their revived profits generously, unlike those focusing solely on future growth investments. Favor has also shifted toward institutions making successful moves outside Europe’s moderate-growth environment.

BBVA’s market value of 64 billion euros, in comparison to Santander’s 69.5 billion euros, has been greatly influenced by its Mexican subsidiary, commanding a quarter of the retail market in the country. “BBVA’s retail bank franchise in Mexico is unparalleled, outperforming even Brazil for Santander,” noted Enrique Quemada, the Chairman of investment bank ONEtoONE Corporate Finance Group.

Investors have lauded BBVA’s strategic decision to exit the United States back in November 2020, opting to focus on enhancing shareholder value through increased cash distributions.

“For growth, profitability, growing dividends, and share buybacks, the market continues to reward us,” stated BBVA Chairman Carlos Torres during a recent shareholder meeting. Torres assumed the chairmanship at the end of 2018, coinciding with Onur Genç’s appointment as BBVA CEO.

Since 2021, BBVA has disbursed 13.19 billion euros to its shareholders, including extraordinary buybacks totaling 4.16 billion euros, representing a substantial 20.6% of its current market valuation according to Reuters’ calculations.

Conversely, Santander, under the leadership of Executive Chair Ana Botin, has demonstrated a more conservative approach in capital distribution, evident in its 12.8 billion euros payout – 18.4% of its market capitalization – based on Reuters’ calculations.

Contrasting Strategies

While BBVA’s approach emphasizes distributing capital to shareholders, fueling its market performance, Santander appears to be more reserved in this aspect, thereby affecting its stock performance negatively. The market trend is leaning towards institutions with generous payout policies like Italy’s UniCredit CRDI.MI, leaving banks such as Santander and BNP Paribas BNPP.PA in a less favorable position.

Santander’s Chief Financial Officer Jose Garcia Cantera discussed the market’s current preference for immediate payouts during high-interest-rate periods, predicting a shift towards valuing future growth as interest rates decline.

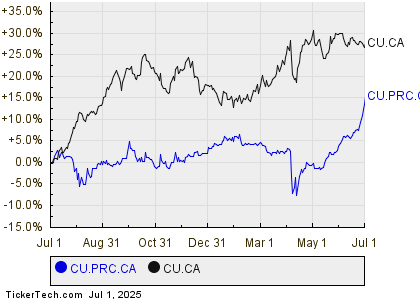

Although Santander has a broader scope and scale compared to BBVA, the latter’s stock trades at over 1.2 times its book value due to a remarkable 32.5% increase in 2024, significantly outperforming Santander’s 15.5% growth over the same period while trading at just over 0.7 times its book value, positioning it in the bottom third of large European banks according to LSEG data.

Future Prospects

BBVA remains focused on delivering strong financial results in its core Mexican and Spanish markets, aiming for a return on tangible equity (ROTE) between 17% to 20% in 2024, up from 17% in 2023. On the other hand, Santander is targeting a ROTE of 16% in 2024, showcasing conservative growth plans compared to BBVA.

Analysts foresee Santander benefiting from cost-savings through global unit expansion and improving performance in its auto lending business in Europe and the U.S. Nonetheless, challenges remain, particularly in enhancing profitability in Brazil and ensuring the success of its U.S. expansion efforts following a significant drop in net profit in the region.

Santander’s strategy of diversifying its business portfolio is expected to yield long-term benefits, according to Cantera. As markets pivot towards valuing growth investments more, banks like Santander that have invested in future prospects are poised to gain a competitive edge.

Santander’s core Tier 1 fully loaded capital ratio stood at 12.26% by the end of last year, slightly lower than BBVA’s 12.67%, amplifying the need for strategic decisions to maintain a robust financial position amidst evolving market dynamics.