Analysts Predict Strong Upside for Vanguard’s Small-Cap ETF

In-depth analysis of the Vanguard S&P Small-Cap 600 ETF (Symbol: VIOO) reveals a notable potential for growth. By comparing current trading prices to the average 12-month target prices set by analysts, we calculated that VIOO’s implied target price is $124.25.

Current Trading Insights

As of now, VIOO trades at approximately $110.46 per unit. This indicates a promising 12.48% upside based on the average targets of its underlying holdings.

Key Holdings with Potential Growth

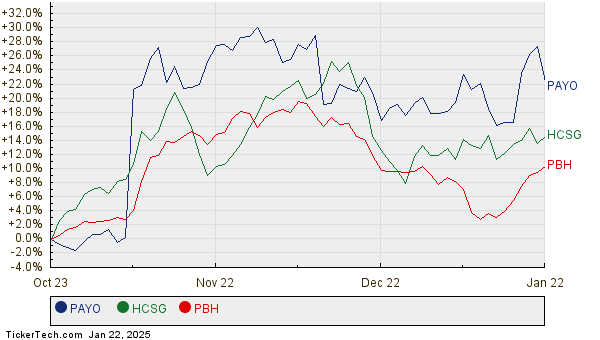

Within VIOO, three specific holdings show significant upside potential relative to analyst targets. Payoneer Global Inc (Symbol: PAYO) recently trades at $10.34 per share, yet analysts target an increase of 16.05% to $12.00 per share. Healthcare Services Group, Inc. (Symbol: HCSG) also presents a favorable outlook, with a current price of $11.82 and a target of $13.60, equating to a 15.06% upside. Finally, Prestige Consumer Healthcare Inc (Symbol: PBH) is valued at $79.30, with an analyst target of $91.20, suggesting a 15.01% increase.

Below is a visual representation tracking the price history of PAYO, HCSG, and PBH:

Analyst Target Summary

The table below summarizes the current analyst target prices for the discussed companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Small-Cap 600 ETF | VIOO | $110.46 | $124.25 | 12.48% |

| Payoneer Global Inc | PAYO | $10.34 | $12.00 | 16.05% |

| Healthcare Services Group, Inc. | HCSG | $11.82 | $13.60 | 15.06% |

| Prestige Consumer Healthcare Inc | PBH | $79.30 | $91.20 | 15.01% |

Future Outlook and Considerations

As these stocks approach their price targets, questions arise about the accuracy of analyst predictions. Are the targets realistic, or are they overly optimistic? A high target price could indicate a positive outlook, but it also risks potential downgrades if market conditions change. Investors should conduct thorough research to evaluate these factors effectively.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• NI shares outstanding history

• XON Insider Buying

• AE Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.