Analysts See Potential Upside for SPDR Russell 1000 Yield Focus ETF

In our examination of ETFs at ETF Channel, we analyzed the trading price of each holding in relation to the average 12-month forward target price set by analysts. For the SPDR Russell 1000 Yield Focus ETF (Symbol: ONEY), we calculated the implied analyst target price to be $119.08 per unit based on its underlying holdings.

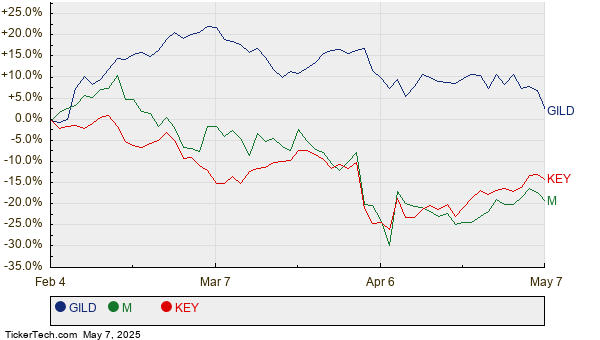

Currently, ONEY is trading around $104.53 per unit. This indicates analysts project a 13.92% upside for this ETF compared to the average targets of its underlying assets. Notably, three holdings—Gilead Sciences Inc (Symbol: GILD), Macy’s Inc (Symbol: M), and KeyCorp (Symbol: KEY)—show significant potential for price appreciation. GILD, for instance, has a recent trading price of $97.88 per share, while its average analyst target stands at $112.76, suggesting a potential upside of 15.20%. Similarly, Macy’s shares are priced at $11.50, with a 14.62% upside forecast to $13.18. Lastly, analysts expect KEY, currently at $15.30, to reach $17.53, marking a 14.56% increase.

Below is a twelve-month price history chart for GILD, M, and KEY:

Summary of Analyst Expectations

The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Russell 1000 Yield Focus ETF | ONEY | $104.53 | $119.08 | 13.92% |

| Gilead Sciences Inc | GILD | $97.88 | $112.76 | 15.20% |

| Macy’s Inc | M | $11.50 | $13.18 | 14.62% |

| KeyCorp | KEY | $15.30 | $17.53 | 14.56% |

The accuracy of these analyst targets raises questions. Are they justified, or are analysts too optimistic about future trading prices for these stocks? Investors should conduct further research into the rationale behind these projections, especially as high targets could indicate optimism that may not align with recent market trends.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• Materials Stocks Hedge Funds Are Buying

• JXI market cap history

• RETL Dividend History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.