Cboe Global Markets Faces Mixed Performance Despite Strong Revenue Growth

Valued at a market cap of $22.6 billion, Cboe Global Markets, Inc. (CBOE) stands as a prominent global exchange operator, offering a diverse range of trading products across multiple asset classes, such as options, equities, futures, foreign exchange, and digital assets. Headquartered in Chicago, Illinois, the company is one of the largest stock exchange operators by volume in the United States and a key player in European markets.

Latest Stock Performance Highlights

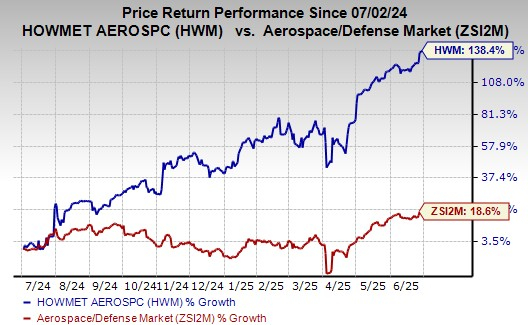

Over the past year, CBOE shares have struggled compared to the overall market. While CBOE has increased by 20.3% in the last 52 weeks, the broader S&P 500 Index ($SPX) has seen gains of 32.6%. In 2024, CBOE shares rose by 20.9%, in contrast to SPX’s 26.5% increase year-to-date.

In comparison, CBOE also fell short against the Financial Select Sector SPDR Fund’s (XLF) 44.6% return over the past year and a 36.5% return on a year-to-date basis.

Q3 Earnings Report and Market Reaction

Cboe reported better-than-expected Q3 net revenue of $532 million and adjusted EPS of $2.22. However, despite these positive figures, shares of CBOE fell by 1.7% on Nov. 1 due to weakness in the U.S. equities segment, which saw a decline in market share. Investors also expressed concern over a forecasted increase in operating expenses to between $798 million and $808 million. Broader macroeconomic factors and a higher effective tax rate contributed to the cautious investor sentiment.

For the current fiscal year ending in December, analysts project CBOE’s EPS to grow by 11% year-over-year to $8.66, with the company showing a history of earnings surprises after beating the consensus estimates in the last four quarters.

Analyst Ratings and Future Outlook

Among the 17 analysts monitoring CBOE, the consensus rating is a “Moderate Buy,” reflecting five “Strong Buy” ratings and 12 “Holds.”

On Nov. 11, Deutsche Bank analyst Brian Bedell upgraded Cboe Global Markets from a “Hold” to a “Buy” rating and established a price target of $222.

As of now, CBOE is trading above the average price target of $213.81, with the highest Street forecast of $232 indicating a possible upside of just 7.5% from current levels.

On the date of publication, Sohini Mondal did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is for informational purposes only. For more details, view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.