Analysts See Significant Upside for Vanguard Russell 1000 Value ETF

At ETF Channel, we analyzed the underlying holdings of key ETFs in our coverage universe. This involved comparing the trading price of each holding against its average analyst 12-month forward target price. For the Vanguard Russell 1000 Value ETF (Symbol: VONV), the weighted average implied analyst target price stands at $91.62 per unit.

Currently, VONV is trading near $75.91 per unit, indicating a potential upside of 20.70%. This projection considers the average analyst targets for its underlying holdings. Among these holdings, three stocks exhibit particularly notable upside: Liberty Broadband Corp (Symbol: LBRDA), Armstrong World Industries Inc (Symbol: AWI), and Leidos Holdings Inc (Symbol: LDOS).

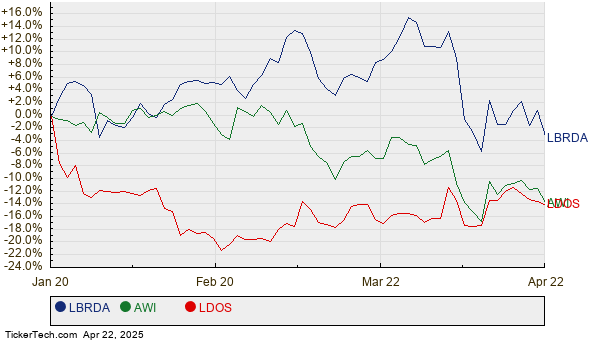

Despite LBRDA’s recent price of $73.69 per share, analysts predict its target to reach $98.40, suggesting a 33.53% increase. Similarly, AWI currently trades at $130.05, but the average target price of $162.86 indicates a potential upside of 25.23%. In the case of LDOS, analysts expect a target price of $171.47 per share, which is 24.04% above its latest price of $138.24. Below is a twelve-month price history chart showing the performance of LBRDA, AWI, and LDOS:

Here is a summary table displaying the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Value ETF | VONV | $75.91 | $91.62 | 20.70% |

| Liberty Broadband Corp | LBRDA | $73.69 | $98.40 | 33.53% |

| Armstrong World Industries Inc | AWI | $130.05 | $162.86 | 25.23% |

| Leidos Holdings Inc | LDOS | $138.24 | $171.47 | 24.04% |

These figures raise important questions for investors. Are analysts justified in their predictions, or do they appear overly optimistic about where these stocks will trade in the next 12 months? Understanding recent company and industry developments is crucial as analysts may be basing targets on outdated information. Additionally, a high price target compared to a stock’s current trading price can indicate optimism for the future but can also lead to potential downgrades if market conditions shift. More in-depth research is needed to evaluate these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• MDVX Videos

• Funds Holding CHAR

• Top Ten Hedge Funds Holding DLTR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.