Tesla’s Stock Price Target Raised Significantly by Wedbush Analyst

Significant Price Increase: Analyst Dan Ives of Wedbush Securities has lifted his price target for Tesla Inc TSLA shares from $400 to $515.

Market Outlook: Ives shared his vision on social media platform X stating, “We believe the Trump White House will be a ‘total game changer’ for the autonomous and AI story for Tesla and Musk over the coming years.” He suggested a bullish scenario, predicting a stock price of $650 by 2025, attributing a substantial opportunity in AI and autonomy to be worth at least $1 trillion.

Ives anticipates that Tesla’s market cap could reach $2 trillion by the end of 2025, assuming that the company’s plans for autonomous driving become more defined. Importantly, the current price target does not yet account for potential growth related to the Optimus humanoid robot, which Ives sees as a potential significant boost for Tesla’s overall narrative.

Stock Performance: Tesla’s stock rose by 4.3% to close at $436.23 last Friday, marking a notable increase of approximately 76% for the year, based on data from Benzinga Pro.

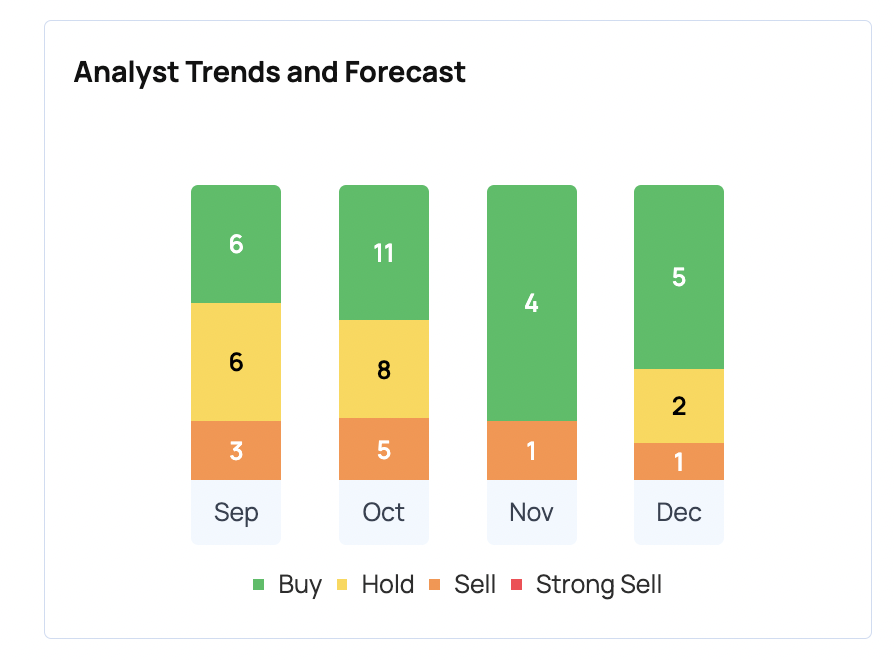

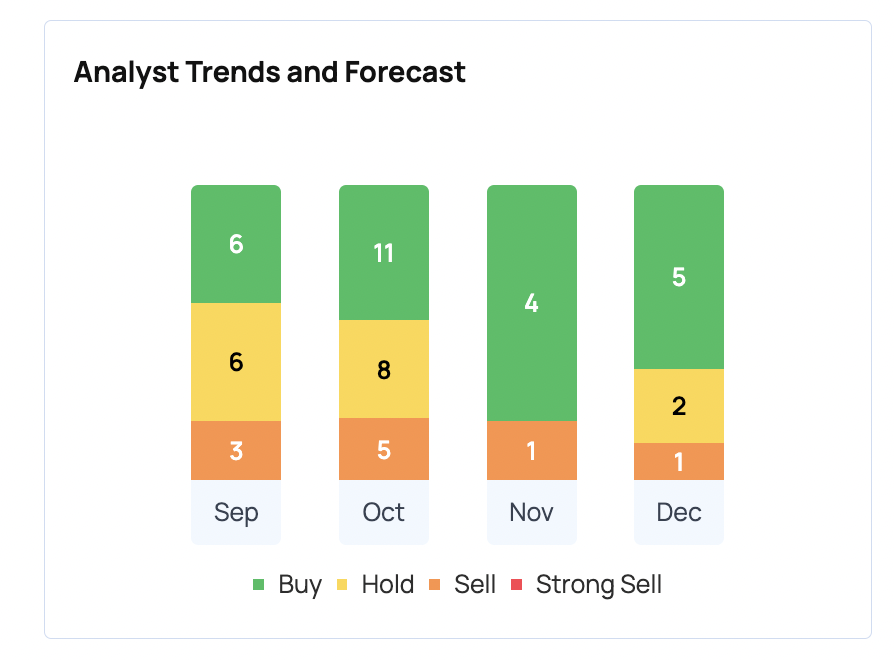

An analysis of 33 financial experts shows a consensus “Buy” rating for Tesla. Brokerage firm Stifel recently set a price target of $411 while maintaining their “buy” recommendation.

Many experts, including Ives, are optimistic that Musk’s new alliance with President-elect Donald Trump will foster a favorable environment for advancing autonomous vehicle deployment. Meanwhile, Trump’s policies could potentially disadvantage smaller competitors in the EV sector, ultimately benefiting Tesla.

Recently, it was revealed that a transition team for Trump is exploring a plan to repeal the requirement to report car crashes involving advanced driver assistance system technologies. Tesla has criticized this requirement in the past.

Musk is focused on expanding Tesla’s capabilities in autonomous driving with features known as full self-driving, which aim to enhance vehicle independence over time.

It was also reported that Trump intends to terminate the $7,500 tax credit for EV purchases provided under the Inflation Reduction Act (IRA).

Musk expressed his view on X by saying, “In my opinion, we should end all government subsidies, including those for EVs, oil, and gas.”

For more information on the evolving mobility landscape, check out Benzinga’s Future Of Mobility coverage.

Next Steps:

Image via Tesla

Market News and Data brought to you by Benzinga APIs