Analysts Predict Significant Upside for First Trust Health Care AlphaDEX Fund ETF

The latest analysis of the First Trust Health Care AlphaDEX Fund ETF (Symbol: FXH) shows promising upside potential based on its underlying holdings.

According to ETF Channel, the implied analyst target price for FXH is $128.17 per unit. Currently, the ETF trades at approximately $111.15. This pricing indicates a potential upside of 15.31%, based on analysts’ projections for its holdings.

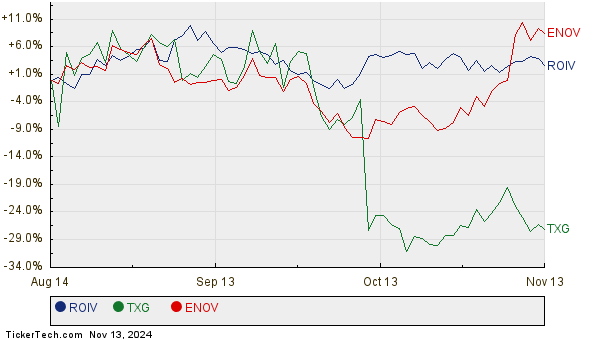

Three notable holdings within FXH present significant upside to their analyst targets: Roivant Sciences Ltd (Symbol: ROIV), 10x Genomics Inc (Symbol: TXG), and Enovis Corp (Symbol: ENOV). ROIV, trading at $11.64, has an average analyst target of $17.05, reflecting a potential increase of 46.52%. For TXG, which is currently priced at $15.68, the average target is $22.23, suggesting a 41.80% upside. Meanwhile, ENOV trades at $46.91, with analysts expecting it to reach $66.50, translating to an upside of 41.76%. Below is a twelve-month price performance chart comparing ROIV, TXG, and ENOV:

A summary table of the current analyst target prices is as follows:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Health Care AlphaDEX Fund ETF | FXH | $111.15 | $128.17 | 15.31% |

| Roivant Sciences Ltd | ROIV | $11.64 | $17.05 | 46.52% |

| 10x Genomics Inc | TXG | $15.68 | $22.23 | 41.80% |

| Enovis Corp | ENOV | $46.91 | $66.50 | 41.76% |

Are the analysts’ targets reasonable, or are they too optimistic? It’s essential for investors to consider if these forecasts are based on current market conditions and company performance updates. A higher target price can signal growth potential, but it may also suggest that analysts could be revising expectations downward. Investors should conduct thorough research to better understand these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Highest Yield Preferreds

• UNL Average Annual Return

• PFFD shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.