Coinbase’s Future Looks Bright with New Developments

Key Financial Insights on Coinbase Global (COIN)

Zacks Rank #1 (Strong Buy) stock Coinbase Global (COIN) leads the United States as the largest cryptocurrency exchange by trading volume. Coinbase provides users access to a wide range of crypto assets, along with trading products that primarily generate transaction revenues and an array of ecosystem offerings that bring in subscription and service revenues. Below are three significant reasons why Coinbase is well-positioned for future growth:

1. Donald Trump Appoints Pro-Crypto Cabinet Members

In November, President-elect Donald Trump made a return to office, continuing with many policies from his 2016 campaign, such as reducing taxes and curbing illegal immigration. However, his stance on cryptocurrency has notably shifted; Trump, previously skeptical, now reportedly holds nearly $8 million in crypto and has plans to appoint pro-crypto nominees to key cabinet positions.

During his campaign, he promised to remove SEC chair Gary Gensler on his first day. Gensler, viewed as an opponent of crypto, will resign in January ahead of potential dismissal and will be replaced by pro-crypto lobbyist Paul Atkins. Trump is not stopping there; he has also announced David Sacks, a notable venture capitalist and member of the “PayPal Mafia,” as his advisor for AI and cryptocurrency. Sacks has previously interviewed Coinbase CEO Brian Armstrong, indicating a favorable relationship with the firm. This shift indicates a potential transformation in crypto regulation towards a more supportive environment.

2. Potential for New Crypto ETFs: Solana and XRP on the Horizon?

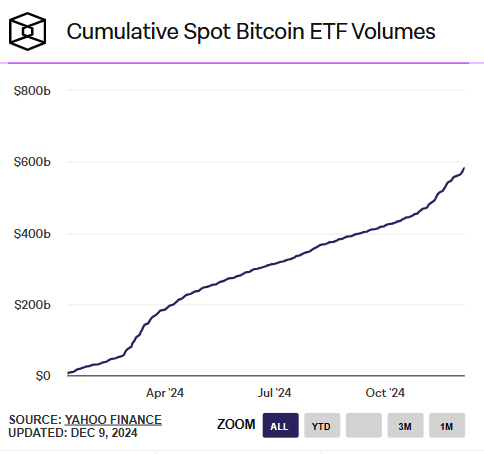

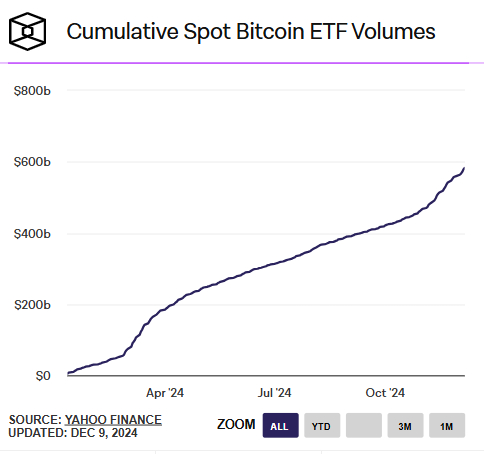

Earlier this year, the iShares Bitcoin ETF (IBIT) and the Fidelity Wise Origin BTC ETF (FBTC) launched successfully, raising over $3 billion in their first month—an all-time record for ETF launches.

Image Source: The Block, Yahoo Finance

As the custodial exchange for most crypto ETFs, Coinbase stands to gain significantly by charging fees on assets under custody and earning transaction fees. With a friendly regulatory atmosphere anticipated, ETF designers are applying for licenses to launch additional products focusing on “altcoins” like Solana (SOL) and Ripple (XRP). If these applications are approved, which is likely given the new administration’s stance, Coinbase could see considerable benefits.

3. Increasing Corporate Adoption of Bitcoin

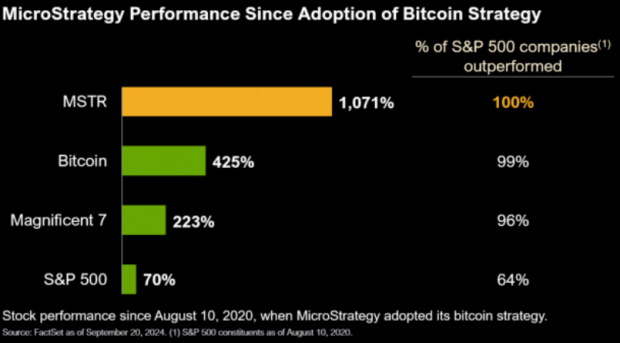

The software firm MicroStrategy (MSTR) has seen remarkable success since it began adding Bitcoin to its assets, outperforming every other asset class.

Image Source: FactSet

Other firms, such as Semler Scientific (SMLR) and Riot Platforms (RIOT) are likewise adopting Bitcoin into their finances, following MicroStrategy’s lead. This surge in demand from public companies will likely result in increased transaction fees and revenues for Coinbase.

Strong Financial Fundamentals at Coinbase

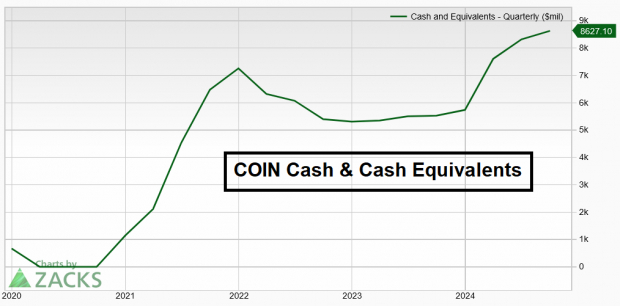

Coinbase shows a remarkable blend of rapid growth and substantial cash reserves. Recently, the company’s earnings per share (EPS) soared by 245% year-over-year. Its cash position has steadily improved since an IPO in 2021.

Image Source: Zacks Investment Research

Analyzing Coinbase’s Technical Position

From a technical viewpoint, COIN shares are forming a traditional IPO base over time. If the fundamentals continue to improve as expected, a breakout in stock price could occur in 2025.

Image Source: TradingView

Conclusion

Coinbase is positioned for notable gains due to a supportive Trump administration for crypto, the potential introduction of new altcoin ETFs, and growing corporate adoption of Bitcoin. With its strong fundamentals and advantageous future outlook, COIN remains a strong long-term investment.

Zacks Highlights Top 10 Stocks for 2025

Want to be among the first to hear about our top stock picks for 2025?

Historical trends suggest their performance could be exceptional.

Since 2012, under the guidance of Sheraz Mian, our Zacks Top 10 Stocks portfolio has achieved a remarkable +2,112.6% performance, significantly outpacing the S&P 500’s +475.6%. Sheraz is meticulously analyzing 4,400 companies to select the top 10 stocks to buy and hold for the upcoming year. Don’t miss out on these opportunities when they are unveiled on January 2.

Be First to New Top 10 Stocks >>

Interested in the latest stock recommendations from Zacks Investment Research? Download today’s report on 5 Stocks Set to Double for more insights.

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

Riot Platforms, Inc. (RIOT): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.