Analysts Predict Significant Upside for Distillate US ETF

At ETF Channel, we analyzed the underlying holdings of ETFs in our coverage and compared each holding’s trading price with the average analyst’s 12-month forward target price. For the Distillate US Fundamental Stability & Value ETF (Symbol: DSTL), we determined that the implied analyst target price based on its holdings is $64.24 per unit.

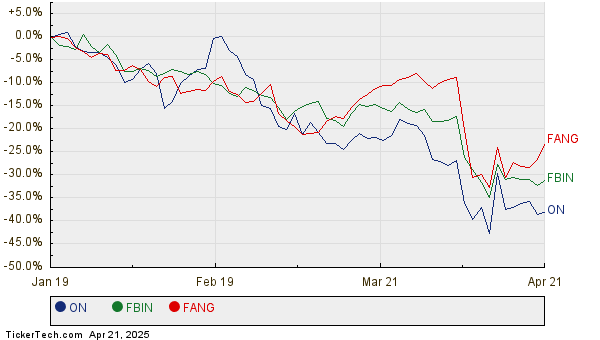

Currently, DSTL is trading around $50.75 per unit. This implies a potential upside of 26.58%, as projected by analysts, who base their targets on the ETF’s underlying assets. Among the notable holdings with upside potential are ON Semiconductor Corp (Symbol: ON), Fortune Brands Innovations Inc (Symbol: FBIN), and Diamondback Energy, Inc. (Symbol: FANG). ON, trading at $34.64 per share, has an average analyst target that is 66.70% higher at $57.75. Furthermore, FBIN shows a potential upside of 51.27% from its recent price of $51.47 to reach an average target of $77.86. Additionally, analysts foresee FANG, which is currently priced at $137.64, reaching a target price of $196.89, representing a 43.05% increase. Below, you will find a twelve-month price history chart illustrating the stock performance of ON, FBIN, and FANG:

Here is a summary table of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Distillate US Fundamental Stability & Value ETF | DSTL | $50.75 | $64.24 | 26.58% |

| ON Semiconductor Corp | ON | $34.64 | $57.75 | 66.70% |

| Fortune Brands Innovations Inc | FBIN | $51.47 | $77.86 | 51.27% |

| Diamondback Energy, Inc. | FANG | $137.64 | $196.89 | 43.05% |

The question remains: Are analysts justified in their target prices, or are they overly optimistic about the future trading range of these stocks within the next year? It’s essential to consider whether analysts have sound reasoning for their targets or if they may be out of touch with current industry trends. A high price target juxtaposed against a stock’s trading price can signify optimism, yet it also risks target price downgrades if the predictions are based on outdated information. Investors are encouraged to perform rigorous research on these topics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Technology Stocks Hedge Funds Are Selling

IDNA Videos

Top Ten Hedge Funds Holding STJ

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.