Gold Soars Above $3,500, Analysts Warn of Potential Correction

Gold has become a prominent asset in 2025, surging over 30% year-to-date and reaching a new all-time high of $3,500.

Though gold’s appeal as a safe-haven asset has grown amidst economic and political instability, experts caution that this rally may be unsustainable.

“Gold surged to a fresh all-time high above $3,500 before giving back some gains,” stated Lukman Otunuga, senior market analyst at FXTM. “While the fundamentals heavily favor bulls, technical indicators are showing that gold is heavily overbought and could be ripe for a correction.”

Read also: Gold Tops $3,500 As Investors Flee To Safety: Mohamed El-Erian Warns Of Global System Shift Amid Trump-Powell Tensions

Concerns regarding the Federal Reserve’s independence—sparked by President Donald Trump‘s threats to dismiss Fed Chair Jerome Powell—along with fears of tariffs and recession, have propelled investors towards gold. Remarkably, even a hawkish Fed stance and a robust dollar have failed to diminish gold’s upward momentum.

However, technical signals may now indicate potential risk. “Depending on the intensity of the correction, prices may slip toward $3,350, $3,200, and $3,140 before bulls re-engage. Conversely, a solid breakout and close above $3,500 could set the stage for reaching the next psychological level at $3,600.”

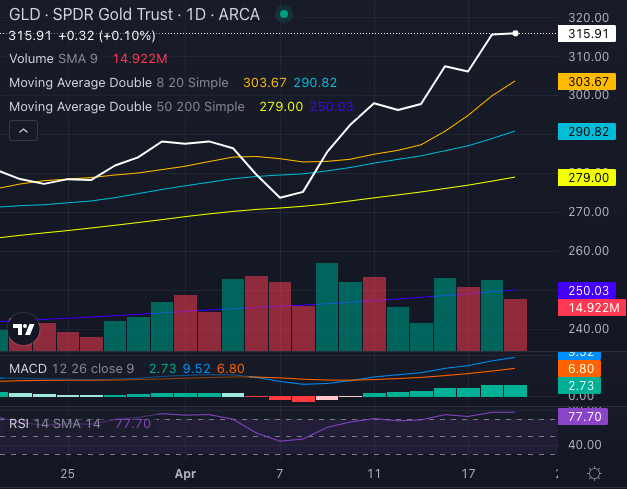

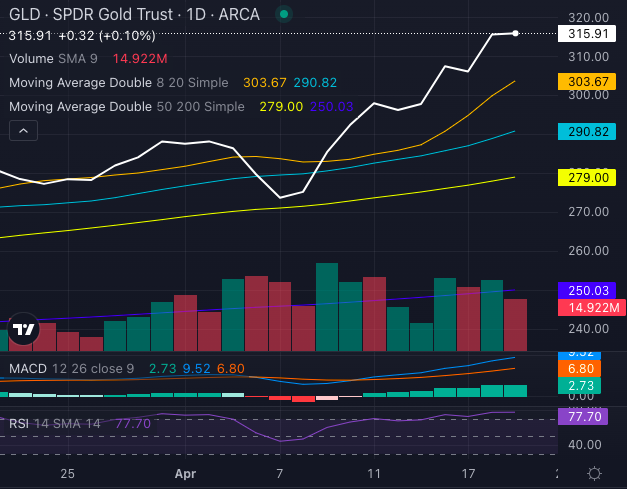

GLD Follows Gold But May Face Increased Volatility

Chart created using Benzinga Pro

For equity investors, the SPDR Gold Trust GLD serves as a key proxy for gold’s performance. It has risen significantly this year, benefitting from gold’s ascent. However, a potential pullback in bullion prices could lead to steeper declines in gold mining stocks due to their operating leverage.

The Relative Strength Index (RSI) for GLD stands at 77.70, indicating it is also overbought and suggesting that a correction may be imminent.

As gold hovers near a possible downturn, investors using GLD as a gold investment might need to exercise caution. A decline in gold prices—although temporary—could negatively impact gold mining stocks, even as the long-term outlook for safe-haven demand remains supportive.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs