Analysts Project Positive Upside for Invesco’s DWAS ETF

In our review of the ETFs within our coverage at ETF Channel, we analyzed the trading prices of individual holdings against the average analyst 12-month forward target prices. After this assessment, we found that the Invesco Dorsey Wright SmallCap Momentum ETF (Symbol: DWAS) has an implied analyst target price of $100.26 per unit based on its underlying holdings.

Currently, DWAS is trading around $76.91 per unit, indicating that analysts anticipate a 30.37% upside for this ETF based on the average targets of its underlying assets. Notably, three of DWAS’s holdings show considerable potential for growth: Bloom Energy Corp (Symbol: BE), Sable Offshore Corp (Symbol: SOC), and Adaptive Biotechnologies Corp (Symbol: ADPT). Bloom Energy is currently priced at $16.81 per share, with an average analyst target of $24.27, reflecting a potential upside of 44.39%. Similarly, Sable Offshore has a recent share price of $20.01 and an average target of $27.67, suggesting a 38.26% upside. Lastly, Adaptive Biotechnologies, trading at $7.36, has an analyst target of $9.71, indicating a 31.98% expected increase.

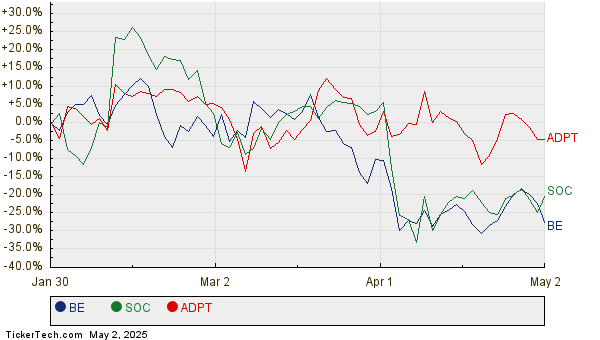

Below is a twelve-month price history chart comparing the stock performance of BE, SOC, and ADPT:

Here’s a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco Dorsey Wright SmallCap Momentum ETF | DWAS | $76.91 | $100.26 | 30.37% |

| Bloom Energy Corp | BE | $16.81 | $24.27 | 44.39% |

| Sable Offshore Corp | SOC | $20.01 | $27.67 | 38.26% |

| Adaptive Biotechnologies Corp | ADPT | $7.36 | $9.71 | 31.98% |

As analysts set these targets, it raises questions about whether they are justified or overly optimistic in their projections. Investors should consider if analysts are accurately reflecting recent developments within these companies and the broader industry landscape. A high price target in comparison to a stock’s trading price might indicate future optimism but could also signal potential downgrades if these targets do not align with emerging realities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

DividendRank Canada

DNOW Insider Buying

Funds Holding NDXP

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.