The Bright Forecast for XME ETF

As per ETF Channel’s deep dive into the holdings of various ETFs, it has been revealed that the implied analyst target price for the SPDR S&P Metals & Mining ETF (XME) stands impressively at $66.15 per unit. This projection has cast a hopeful shadow on investors eyeing XME, currently traversing near $57.94 per unit, implying a potential 14.18% upside.

Glancing Across the Landscape

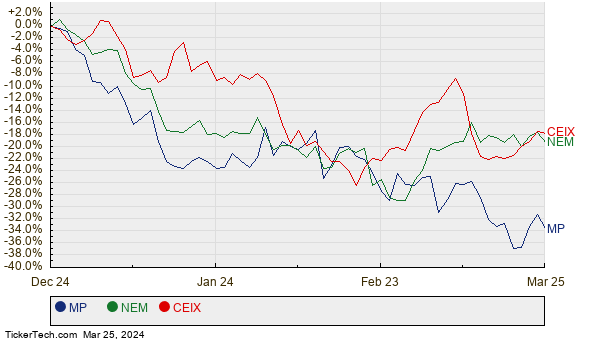

With names like MP Materials Corp (MP), Newmont Corp (NEM), and CONSOL Energy Inc (CEIX) tugging at the overall performance of XME, the analysis is laced with anticipation. MP’s stock is envisioned to soar by 77.53% to $24.25/share from $13.66/share, while NEM boasts a projected hike of 38.82% to $46.88/share from a recent $33.77/share. CEIX, with a current price of $85.17/share, is anticipated to ascend by 20.35% to $102.50.

The Anatomy of Analyst Projections

In a nutshell, MP, NEM, and CEIX collectively account for 12.83% of the SPDR S&P Metals & Mining ETF. The following table outlines the current analyst target prices dissected earlier:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P Metals & Mining ETF | XME | $57.94 | $66.15 | 14.18% |

| MP Materials Corp | MP | $13.66 | $24.25 | 77.53% |

| Newmont Corp | NEM | $33.77 | $46.88 | 38.82% |

| CONSOL Energy Inc | CEIX | $85.17 | $102.50 | 20.35% |

The projected targets by analysts raise the vital question about the credibility of these forecasts. Are the analysts on the money, or are they painting a rosier picture than reality dictates? These targets, while instilling hope, also bear the risk of being lag behind in light of recent market and industry movements.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Further Investigation:

MPC Dividend Growth Rate

Institutional Holders of GMAY

Packaging Corp of America 13F Filers

The expressed opinions and viewpoints are solely those of the author and may not necessarily mirror those of Nasdaq, Inc.