DGRW ETF Shows Promising Upside Potential, Analysts Suggest

The recent analysis of the WisdomTree U.S. Quality Dividend Growth Fund ETF (Symbol: DGRW) reveals a significant upside potential based on analyst target prices for its holdings.

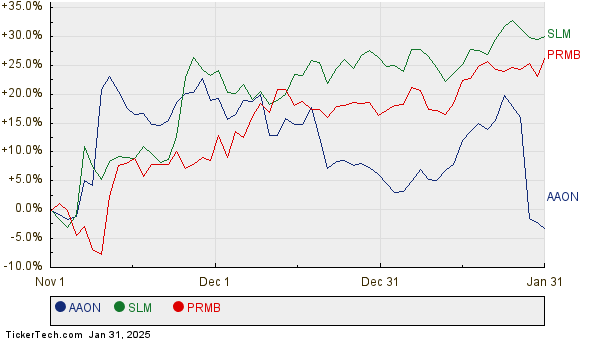

According to our evaluation at ETF Channel, the weighted average implied analyst target price for DGRW stands at $93.96 per unit. Given that DGRW is currently trading at approximately $84.02, this indicates an expected upside of 11.83%. Notably, three of DGRW’s key underlying holdings exhibit notable growth potential: AAON, Inc. (Symbol: AAON), SLM Corp. (Symbol: SLM), and Primo Brands Corp-A (Symbol: PRMB). AAON, which recently traded at $116.60 per share, has an average analyst target price of $133.00, marking a 14.07% upside. Meanwhile, SLM Corp. shows a potential increase of 13.74%, with the target price set at $32.67, against a recent price of $28.72. For PRMB, the analysts foresee a target price of $37.20, representing an upside of 11.98% from its current price of $33.22. Below, you can view a twelve-month price history chart comparing the stock performance of AAON, SLM, and PRMB:

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. Quality Dividend Growth Fund ETF | DGRW | $84.02 | $93.96 | 11.83% |

| AAON, Inc. | AAON | $116.60 | $133.00 | 14.07% |

| SLM Corp. | SLM | $28.72 | $32.67 | 13.74% |

| Primo Brands Corp-A | PRMB | $33.22 | $37.20 | 11.98% |

As these analysts release their targets, investment questions arise: Are their forecasts based on solid rationale, or are they overly optimistic given recent trends? While a higher target price relative to a stock’s trading price may signal confidence in future growth, it might also raise concerns about potential downgrades if expectations are unrealistically high. Investors are encouraged to conduct further research to evaluate these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding APYX

• GNCA Videos

• RFIL YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.