Examining Analyst Targets: Potential Upsides for IVV and Key Holdings

At ETF Channel, we analyze the underlying holdings of various ETFs. For the iShares Core S&P 500 ETF (Symbol: IVV), the calculated implied analyst target price based on its holdings stands at $673.92 per unit.

Current Trading Position and Future Projections

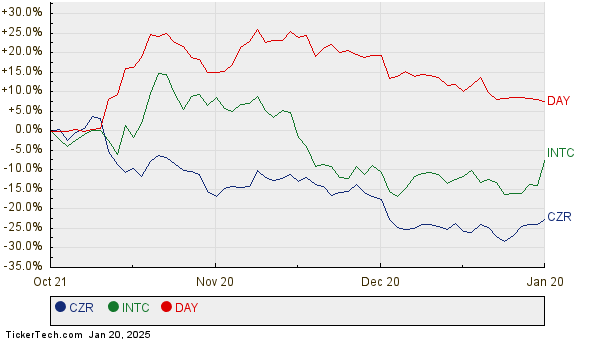

IVV is currently priced at about $600.26 per unit. This suggests that analysts anticipate a potential upside of 12.27% for the ETF based on the average targets assigned to its underlying holdings. Notably, three significant stocks within IVV present considerable upside potential: Caesars Entertainment Inc (Symbol: CZR), Intel Corp (Symbol: INTC), and Dayforce Inc (Symbol: DAY). CZR is currently trading at $34.05 per share, yet analysts have set an average target at $51.91, indicating a possible upside of 52.44%. Intel, priced at $21.48, has an average target of $26.00, leading to a potential 21.04% upside. Meanwhile, DAY, trading at $69.62, is expected to reach an average target of $84.06, reflecting a 20.74% potential increase. Below, you can find the 12-month price history for CZR, INTC, and DAY:

Summary of Analyst Targets

The following table summarizes the current analyst target prices for the stocks mentioned:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P 500 ETF | IVV | $600.26 | $673.92 | 12.27% |

| Caesars Entertainment Inc | CZR | $34.05 | $51.91 | 52.44% |

| Intel Corp | INTC | $21.48 | $26.00 | 21.04% |

| Dayforce Inc | DAY | $69.62 | $84.06 | 20.74% |

Analyst Targets: A Double-Edged Sword?

Are these price targets realistic? Investors should consider whether analysts have adequately accounted for recent developments in these companies or if they remain overly optimistic. Target prices that significantly exceed current trading prices might signal positive future expectations but could also indicate vulnerable targets susceptible to downward adjustments. Investors are encouraged to conduct further research to clarify these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding FFIE

• Funds Holding HEQ

• SCMP Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.