Analysts Predict Significant Upside for Invesco S&P 100 Equal Weight ETF

In our analysis of ETFs at ETF Channel, we evaluated the underlying holdings of the Invesco S&P 100 Equal Weight ETF (Symbol: EQWL). By comparing the trading prices of each holding to the average analyst 12-month forward target price, we calculated a weighted average implied analyst target price for EQWL. This analysis reveals an implied target price of $119.32 per unit for EQWL.

Currently, as EQWL trades at approximately $104.85 per unit, analysts suggest an upside potential of 13.80% based on the average targets of the ETF’s underlying holdings. Notably, three of EQWL’s holdings show significant upside potential to their respective analyst target prices: Target Corp (Symbol: TGT), BlackRock Inc (Symbol: BLK), and Booking Holdings Inc (Symbol: BKNG).

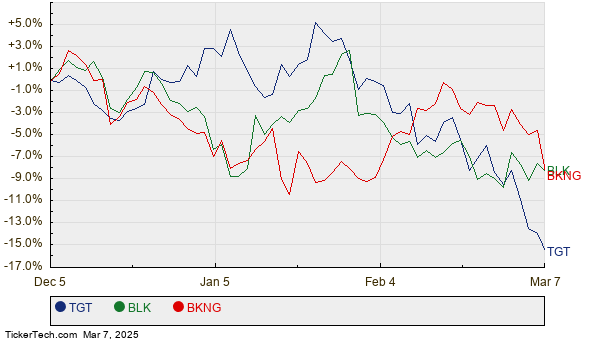

Target recently traded at $114.05 per share, yet the average analyst target stands 27.90% higher at $145.88 per share. BlackRock’s recent price of $959.64 implies a potential upside of 22.29% when compared to the average target price of $1,173.59 per share. Furthermore, analysts project Booking Holdings to reach a target price of $5,610.83, reflecting a 19.48% increase from the current trading price of $4,695.97. Below is a twelve-month price history chart comparing the stock performance of TGT, BLK, and BKNG:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 100 Equal Weight ETF | EQWL | $104.85 | $119.32 | 13.80% |

| Target Corp | TGT | $114.05 | $145.88 | 27.90% |

| BlackRock Inc | BLK | $959.64 | $1,173.59 | 22.29% |

| Booking Holdings Inc | BKNG | $4,695.97 | $5,610.83 | 19.48% |

As investors analyze these potential price targets, questions arise about the realism of analyst expectations. Are the targets overly optimistic for these stocks over the next 12 months? Additionally, do analysts have solid reasons for their predictions, or are they lagging behind significant market developments? A high price target relative to a stock’s trading price may indicate optimism, but it could also result in future downgrades if the targets become outdated. These topics highlight the importance of thorough investor research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• Dividend Giants Widely Held by ETFs

• YQQQ Videos

• Top Ten Hedge Funds Holding FRA

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.