Analysts See Significant Upside for Vanguard Russell 1000 Value ETF

At ETF Channel, we analyzed the underlying holdings of the ETFs in our coverage universe. By comparing the trading price of each holding to the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the Vanguard Russell 1000 Value ETF (Symbol: VONV). The result shows that the implied analyst target price for VONV is $95.30 per unit.

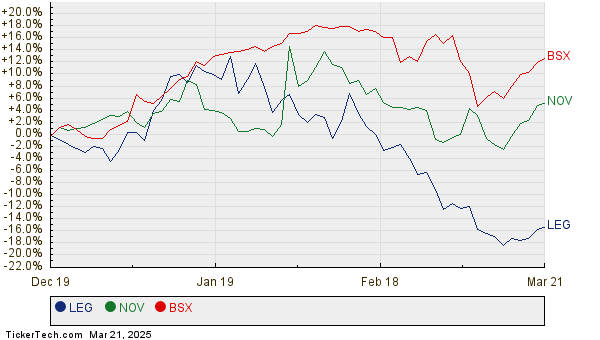

Currently, VONV is trading at approximately $82.88 per unit, indicating that analysts foresee a 14.99% upside based on the average targets of its underlying holdings. Notably, three of VONV’s holdings—Leggett & Platt, Inc. (Symbol: LEG), NOV Inc. (Symbol: NOV), and Boston Scientific Corp. (Symbol: BSX)—show considerable potential for price increases. For instance, LEG is trading at $8.30 per share, yet the average analyst target stands at $11.67, reflecting a potential upside of 40.55%. Similarly, NOV is priced at $15.10, with an upside of 25.50% toward its target of $18.95. BSX is currently valued at $101.51, and analysts predict it could reach a target price of $118.57, representing a 16.81% increase.

Below, see a twelve-month price history chart comparing the stock performance of LEG, NOV, and BSX:

A summary of the current analyst target prices is provided in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Value ETF | VONV | $82.88 | $95.30 | 14.99% |

| Leggett & Platt, Inc. | LEG | $8.30 | $11.67 | 40.55% |

| NOV Inc | NOV | $15.10 | $18.95 | 25.50% |

| Boston Scientific Corp. | BSX | $101.51 | $118.57 | 16.81% |

Investors may wonder if analysts are justified in setting these targets or if they are overly optimistic regarding future stock prices. The rationale behind high price targets relative to trading prices may indicate optimism, though they could also lead to target downgrades if past sentiments are no longer valid. These considerations warrant further research from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• Financial Stocks Hedge Funds Are Buying

• SMSI Stock Predictions

• Institutional Holders of TDSE

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.