Analysts See Significant Upside for Invesco MSCI USA ETF

At ETF Channel, we’ve analyzed the holdings of various ETFs, comparing their current trading prices against the average analyst 12-month forward target prices. Our research indicates that the Invesco MSCI USA ETF (Symbol: PBUS) has an implied analyst target price of $65.99 per share based on its underlying assets.

As of now, PBUS is trading at approximately $56.83 per unit. This suggests that analysts forecast a potential upside of 16.13% for the ETF, according to their projections for its underlying holdings. Notably, three of PBUS’s holdings show considerable upside potential: DraftKings Inc (Symbol: DKNG), Westlake Corp (Symbol: WLK), and Bio-Rad Laboratories Inc (Symbol: BIO).

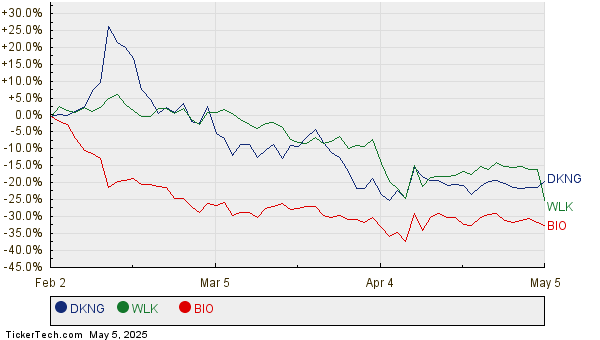

DraftKings is currently trading at $34.25 per share, while analysts suggest a target of $55.23, implying a 61.26% upside. Westlake Corp shares are priced at $79.85, with an average target of $121.25, indicating a 51.85% potential increase. Bio-Rad is at $236.34 per share, but analysts expect its price to reach $350.40—a 48.26% rise. Below is a twelve-month price history chart for DKNG, WLK, and BIO:

The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco MSCI USA ETF | PBUS | $56.83 | $65.99 | 16.13% |

| DraftKings Inc | DKNG | $34.25 | $55.23 | 61.26% |

| Westlake Corp | WLK | $79.85 | $121.25 | 51.85% |

| Bio-Rad Laboratories Inc | BIO | $236.34 | $350.40 | 48.26% |

Investors must analyze whether analysts’ targets are justified or overly optimistic regarding future stock prices. Contextual understanding of recent company developments is essential. Elevated price targets compared to current trading prices could indicate optimism but may also lead to potential downgrades if targets don’t meet forthcoming developments. Further research is warranted.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Joel Greenblatt Stock Picks

• IQV Options Chain

• ETFs Holding CLCD

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.