Analysts Predict Bright Future for iShares Core S&P Small-Cap ETF

Recent evaluations of the iShares Core S&P Small-Cap ETF (Symbol: IJR) show a promising outlook based on its underlying holdings. With an implied analyst target price of $135.52 per unit, IJR presents a potential upside for investors.

Strong Upside Potential Shows Optimism

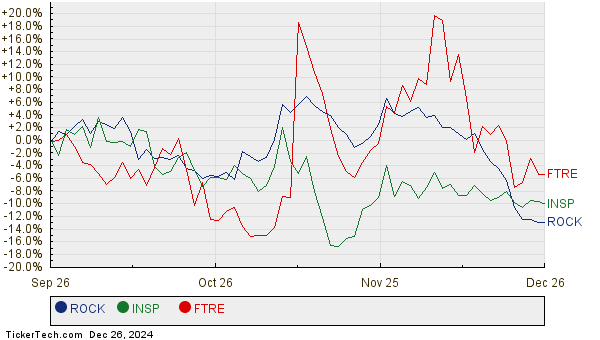

Currently, IJR is trading at approximately $116.60 per unit, suggesting analysts believe there is a 16.23% upside to this ETF in the next year. Notable underlying holdings for IJR include Gibraltar Industries Inc (Symbol: ROCK), Inspire Medical Systems Inc (Symbol: INSP), and Fortrea Holdings Inc (Symbol: FTRE). Each of these companies possesses significant potential to reach their target prices, signaling optimism in their future performance.

Key Holdings with Promising Upsides

Gibraltar Industries Inc (ROCK) is priced at $60.30 per share, yet analysts see a target of $90.00 per share, indicating a potential upside of 49.25%. Inspire Medical Systems Inc (INSP), currently at $186.29, shows a target of $239.60, suggesting an upside of 28.62%. Lastly, Fortrea Holdings Inc (FTRE), trading at $18.75, has a target of $22.30, potentially offering a gain of 18.93%. Below is a chart showcasing their 12-month price history.

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P Small-Cap ETF | IJR | $116.60 | $135.52 | 16.23% |

| Gibraltar Industries Inc | ROCK | $60.30 | $90.00 | 49.25% |

| Inspire Medical Systems Inc | INSP | $186.29 | $239.60 | 28.62% |

| Fortrea Holdings Inc | FTRE | $18.75 | $22.30 | 18.93% |

Analysts’ Targets: Realistic or Overly Optimistic?

This leads to an important consideration: are the analysts’ targets justified? While high price targets can reflect optimism, they may also reflect past performance rather than future potential. Investors should conduct thorough research to determine validity in these projections, especially in light of the recent developments in both companies and their industries.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• High-Yield Canadian Energy Stocks

• Institutional Holders of HEET

• ACI Dividend History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.