Analysts Predict Significant Upside for Vanguard S&P Mid-Cap 400 Value ETF

Recent evaluations of the Vanguard S&P Mid-Cap 400 Value ETF (Symbol: IVOV) reveal potential growth based on analysts’ price targets. The ETF’s underlying holdings suggest an implied target price of $105.54 per unit.

Current Trading Price and Implied Upside

Currently, IVOV is trading around $95.77 per unit, indicating a possible upside of 10.20% when aligned with analyst targets. Key holdings expected to perform well include Capri Holdings Ltd (Symbol: CPRI), Exponent Inc. (Symbol: EXPO), and TKO Group Holdings Inc (Symbol: TKO). For instance, CPRI’s recent price of $21.26 is significantly below its average target of $44.60, marking a potential increase of 109.78%. In comparison, EXPO, trading at $96.92, has a target of $115.00, suggesting an 18.65% rise. Lastly, TKO currently at $115.25 could see an 18.11% boost if it meets its target of $136.12.

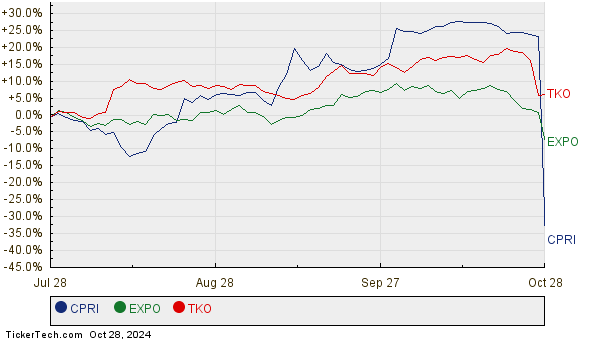

Below is a twelve-month price performance chart for CPRI, EXPO, and TKO:

Analysts’ Target Prices Summary

Below is a detailed overview of the current analyst target prices for some companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 Value ETF | IVOV | $95.77 | $105.54 | 10.20% |

| Capri Holdings Ltd | CPRI | $21.26 | $44.60 | 109.78% |

| Exponent Inc. | EXPO | $96.92 | $115.00 | 18.65% |

| TKO Group Holdings Inc | TKO | $115.25 | $136.12 | 18.11% |

Examining Analyst Optimism

As we consider these target prices, investors should question whether analyst expectations are justified or unrealistic given recent trends in company performance and industry dynamics. Although a higher target price might indicate optimism about the future, it can also lead to potential downgrades if expectations are not met. Investors are encouraged to conduct further research to assess these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Best High Yield Stocks

• Pool Technical Analysis

• WDC DMA

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.