Analyst Targets Suggest Potential Upside for Invesco Dorsey Wright Technology Momentum ETF

In our examination of exchange-traded funds (ETFs) at ETF Channel, we analyzed the trading prices of individual holdings against average analyst target prices. For the Invesco Dorsey Wright Technology Momentum ETF (Symbol: PTF), the weighted average implied analyst target price stands at $79.18 per unit.

Current Price Shows Room for Growth

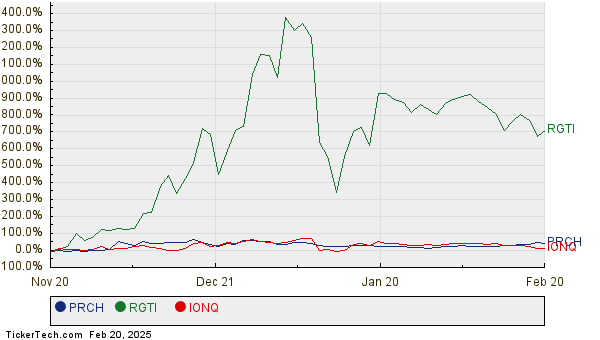

PTF is currently trading around $72.04 per unit, signaling a projected 9.91% upside based on analysts’ expectations for its underlying holdings. Noteworthy individual stocks that could drive this growth include Porch Group Inc (Symbol: PRCH), Rigetti Computing Inc (Symbol: RGTI), and IonQ Inc (Symbol: IONQ). While PRCH’s recent trading price is $5.16 per share, analysts predict a target of $6.21 per share, reflecting a significant 20.43% upside. Similarly, RGTI shows potential with an 11.51% upside from its current price of $11.03, aiming for an average analyst target of $12.30. IonQ also holds promise, with analysts expecting its stock to reach a target price of $37.60 per share, which represents a 10.13% increase from its latest price of $34.14. Below is a chart of the recent performance of these stocks:

A Key Contribution to the ETF’s Performance

Collectively, PRCH, RGTI, and IONQ contribute 11.63% to the performance of the Invesco Dorsey Wright Technology Momentum ETF. The following table summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco Dorsey Wright Technology Momentum ETF | PTF | $72.04 | $79.18 | 9.91% |

| Porch Group Inc | PRCH | $5.16 | $6.21 | 20.43% |

| Rigetti Computing Inc | RGTI | $11.03 | $12.30 | 11.51% |

| IonQ Inc | IONQ | $34.14 | $37.60 | 10.13% |

Investor Research Critical for Future Outlook

As these analysts project their targets, it raises questions about whether their optimism is well-founded or overly ambitious. Investors must consider the validity of these forecasts in light of recent company and industry developments. A price target that is significantly higher than a stock’s current trading price can suggest a positive outlook but might also indicate outdated expectations that could eventually lead to downgrades. Thorough research will be essential for investors navigating these potential risks.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of IBHD

• Institutional Holders of VYFC

• FTAG Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.