FTQI Analysts Target Price Forecasts 9.75% Upside Potential

An analysis of ETFs by ETF Channel compares trading prices to average analyst 12-month forward target prices. The First Trust Nasdaq BuyWrite Income ETF (Symbol: FTQI) has an implied analyst target price of $20.98 per unit based on its holdings.

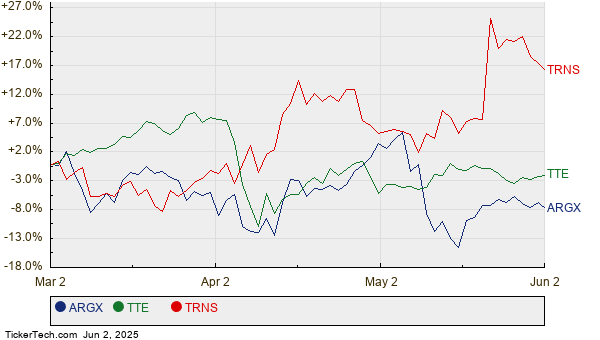

Currently trading at approximately $19.12 per unit, FTQI is expected to see a 9.75% upside, according to analyst forecasts. Notable underlying holdings include argenx SE (Symbol: ARGX), TotalEnergies SE (Symbol: TTE), and Transcat Inc (Symbol: TRNS). Although ARGX’s recent price is $573.26, its average analyst target is $746.91, reflecting a 30.29% upside. TTE, priced recently at $58.68, has a target of $68.92, a potential increase of 17.45%. TRNS’s recent price of $87.50 has an average target price of $102.00, indicating a 16.57% upside.

Below is a price history chart comparing the stock performance of ARGX, TTE, and TRNS:

Here’s a summary table of the discussed analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Nasdaq BuyWrite Income ETF | FTQI | $19.12 | $20.98 | 9.75% |

| argenx SE | ARGX | $573.26 | $746.91 | 30.29% |

| TotalEnergies SE | TTE | $58.68 | $68.92 | 17.45% |

| Transcat Inc | TRNS | $87.50 | $102.00 | 16.57% |

Investors question whether analysts’ targets are justified or overly optimistic given current market trends. High upside targets suggest optimism, yet they might lead to downgrades if based on outdated data. Further research is essential for informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• Preferred Stock ETFs

• MAMS YTD Return

• DATS Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.