Analysts Predict Growth for Xtrackers MSCI Kokusai Equity ETF

Study reveals potential upside for KOKU and key underlying holdings.

At ETF Channel, we examined the ETFs in our coverage. We compared the trading prices of each holding to the average analysts’ 12-month target prices. For the Xtrackers MSCI Kokusai Equity ETF (Symbol: KOKU), the average implied target price stands at $112.06 per unit, based on its underlying assets.

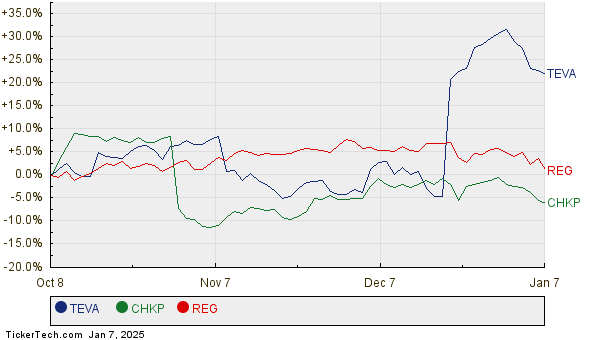

Currently trading at around $102.26 per unit, KOKU appears to have an upside of 9.59%. Analysts believe there is room for growth based on their predictions for the ETF’s components. Notably, three holdings show significant potential: Teva Pharmaceutical Industries Ltd (Symbol: TEVA), Check Point Software Technologies, Ltd. (Symbol: CHKP), and Regency Centers Corp (Symbol: REG). TEVA is trading at $21.07 per share, but analysts project a target of $24.17, indicating a 14.69% upside. Similarly, CHKP, currently at $179.88, has an expected target of $201.50, suggesting a potential increase of 12.02%. REG is priced at $71.08, with a target of $79.41, offering an upside of 11.72%. Below is a chart illustrating the twelve-month price history of TEVA, CHKP, and REG:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Xtrackers MSCI Kokusai Equity ETF | KOKU | $102.26 | $112.06 | 9.59% |

| Teva Pharmaceutical Industries Ltd | TEVA | $21.07 | $24.17 | 14.69% |

| Check Point Software Technologies, Ltd. | CHKP | $179.88 | $201.50 | 12.02% |

| Regency Centers Corp | REG | $71.08 | $79.41 | 11.72% |

Do analysts have valid reasons for their targets, or are they being overly optimistic about these stocks for the next year? High price targets could indicate confidence, but they risk being considered outdated should market conditions change. Investors should conduct further research to form their own conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Cheap Smallcap Stocks

• NSEC Split History

• Top Ten Hedge Funds Holding SYPR

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.