Analysts Predict Positive Upside for Invesco NASDAQ 100 ETF

An analysis of ETFs reveals compelling prospects for investors as market experts weigh in.

At ETF Channel, we evaluated the underlying holdings of various ETFs. We compared each holding’s trading price to the average 12-month price target predicted by analysts, ultimately calculating a weighted average implied target price for the ETF itself. For the Invesco NASDAQ 100 ETF (Symbol: QQQM), the implied analyst target price stands at $225.27 per unit.

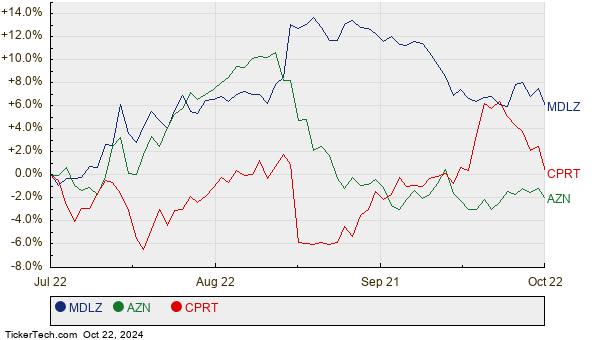

Currently, QQQM trades around $203.89 per unit, suggesting analysts foresee a 10.48% potential upside for this ETF. Noteworthy underlying holdings that could contribute to this upside include Mondelez International Inc (Symbol: MDLZ), AstraZeneca plc (Symbol: AZN), and Copart Inc (Symbol: CPRT). MDLZ, for example, has a recent trading price of $70.43 per share, but analysts target an average of $80.57 per share, reflecting a 14.40% rise. AZN, priced at $77.44, has an 11.64% upside towards its average target of $86.46 per share. Meanwhile, CPRT’s recent price of $52.56 underscores an 11.44% potential increase, as analysts expect it to reach an average target price of $58.57.

Below is a twelve-month price performance chart comparing the stocks of MDLZ, AZN, and CPRT:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco NASDAQ 100 ETF | QQQM | $203.89 | $225.27 | 10.48% |

| Mondelez International Inc | MDLZ | $70.43 | $80.57 | 14.40% |

| AstraZeneca plc | AZN | $77.44 | $86.46 | 11.64% |

| Copart Inc | CPRT | $52.56 | $58.57 | 11.44% |

Are these analysts justified in their targets, or are they being overly optimistic about future stock performances? Investors should consider whether analysts have valid reasons for their projections or if they may be behind on recent developments in the companies and industries involved. A higher price target related to a stock’s current price might indicate an optimistic future outlook, though it can also signal potential downgrades if those targets no longer reflect current realities. Further research will be essential for investors looking to navigate these forecasts.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Institutional Holders of WMS

Funds Holding INTU

PHIN Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.