Analyst Projections Indicate Potential Upside for Vanguard Mid-Cap ETF

In our latest analysis at ETF Channel, we evaluated the underlying holdings of various ETFs. Specifically, we calculated the trading prices of these holdings against their average analyst 12-month forward target prices. For the Vanguard Mid-Cap ETF (Symbol: VO), the weighted average implied target price based on its holdings stands at $296.82 per unit.

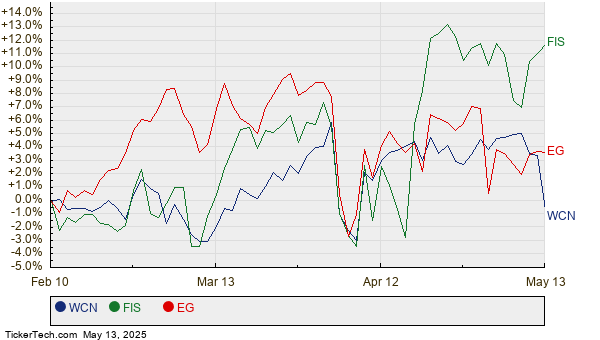

Currently trading around $269.21, VO suggests an upside of 10.26% as analysts predict upward movement in line with their target prices. Among VO’s notable underlying holdings, Waste Connections Inc (Symbol: WCN), Fidelity National Information Services Inc (Symbol: FIS), and Everest Group Ltd (Symbol: EG) show significant potential for growth. WCN, trading at $186.58 per share, has an average target price of $214.99, indicating a 15.23% upside. Similarly, FIS shows a 12.88% upside with a recent price of $78.88 and a target of $89.04. Additionally, analysts anticipate that EG will reach $390.62 per share, reflecting a 12.31% increase from its current price of $347.80. Below is a twelve-month price history chart for WCN, FIS, and EG:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Mid-Cap ETF | VO | $269.21 | $296.82 | 10.26% |

| Waste Connections Inc | WCN | $186.58 | $214.99 | 15.23% |

| Fidelity National Information Services Inc | FIS | $78.88 | $89.04 | 12.88% |

| Everest Group Ltd | EG | $347.80 | $390.62 | 12.31% |

Are analysts accurate in these predictions, or do they display excessive optimism regarding future trading prices? Investors should consider whether the analysts’ targets are justified based on recent company and industry developments. A high target price relative to a stock’s trading price may indicate optimism but could also signal the risk of future downgrades. These questions necessitate further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Other Insights:

GMGI shares outstanding history

Funds Holding MRDN

Funds Holding MACA

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.