Analyst Predictions Suggest Upside Potential for Vanguard Communication Services ETF

ETF Channel has assessed the Vanguard Communication Services ETF (Symbol: VOX) and its underlying holdings, calculating an implied analyst target price of $171.33 per unit for the ETF itself.

Current Trading and Future Outlook

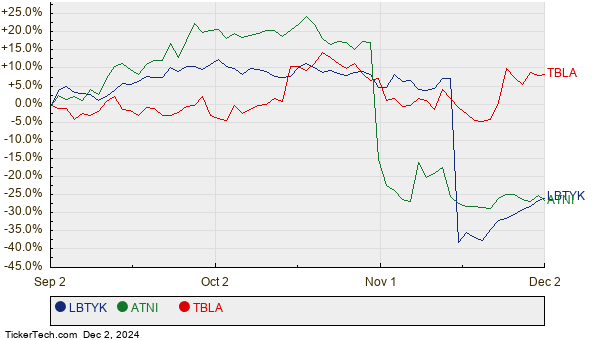

Trading recently at approximately $155.53 per unit, VOX shows a potential upside of 10.16%, based on the average analyst targets for its holdings. Notable stocks with significant upside include Liberty Global Ltd (Symbol: LBTYK), ATN International Inc (Symbol: ATNI), and Taboola.com Ltd (Symbol: TBLA). For instance, LBTYK is priced at $14.62 per share, with a target of $28.00—an increase of 91.52%. ATNI, currently at $19.78, has a target of $32.67, equating to a 65.15% upside. Furthermore, TBLA is expected to rise from $3.56 to a target of $5.33, representing a 49.80% increase. A chart comparing the performance of these stocks over the past twelve months is displayed below:

Summary of Analyst Target Prices

Below is a table summarizing current analyst target prices for the ETF and its notable holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Communication Services ETF | VOX | $155.53 | $171.33 | 10.16% |

| Liberty Global Ltd | LBTYK | $14.62 | $28.00 | 91.52% |

| ATN International Inc | ATNI | $19.78 | $32.67 | 65.15% |

| Taboola.com Ltd | TBLA | $3.56 | $5.33 | 49.80% |

Investors should consider whether these analyst targets are reasonable expectations or overly optimistic. Is the justification for these targets based on recent developments in the companies or the industry? A high price target in relation to a stock’s current trading price might indicate future growth potential but could also lead to downward adjustments if those targets are not met. Investor research will be crucial in addressing these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SSAA YTD Return

• LOMA market cap history

• HE Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.