Vanguard S&P Mid-Cap 400 Value ETF Shows Promising Analyst Upside Potential

In-depth analysis from ETF Channel indicates bullish forecasts for investments in the Vanguard S&P Mid-Cap 400 Value ETF (Symbol: IVOV). The ETF’s current holdings suggest strong potential for growth.

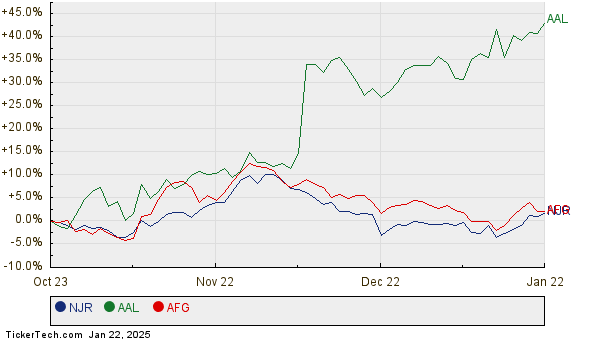

The implied analyst target price for IVOV sits at $110.85 per unit. This contrasts with its recent trading price of $100.28 per unit, indicating a notable 10.54% upside according to analysts’ predictions for its underlying assets. Underlying holdings with significant upside include New Jersey Resources Corp (Symbol: NJR), American Airlines Group Inc (Symbol: AAL), and American Financial Group Inc (Symbol: AFG). Currently priced at $47.79 per share, NJR has an average target of $53.40, suggesting an 11.74% increase. AAL shows a similar trend, with a recent trading price of $18.64 and an expected target of $20.72, reflecting an 11.16% upside. Meanwhile, AFG’s recent price of $135.14 pairs with a target of $149.40, indicating a 10.55% potential rise. A twelve-month historical performance chart is provided below for a visual comparison:

The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Mid-Cap 400 Value ETF | IVOV | $100.28 | $110.85 | 10.54% |

| New Jersey Resources Corp | NJR | $47.79 | $53.40 | 11.74% |

| American Airlines Group Inc | AAL | $18.64 | $20.72 | 11.16% |

| American Financial Group Inc | AFG | $135.14 | $149.40 | 10.55% |

Investors may wonder if analysts are being realistic with their target prices or if they are overly optimistic about the future valuations of these stocks. Historical trends suggest that high price targets can sometimes lead to downgrades if they no longer align with current market conditions. Thorough investor research is advised to navigate these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding RNR

• Institutional Holders of INSW

• Top Ten Hedge Funds Holding ACHN

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.