Analysts Predict Growth for iShares Dow Jones U.S. ETF Amid Mixed Market Sentiment

In a recent evaluation of key ETFs at ETF Channel, we’ve analyzed the trading prices of underlying holdings against the average 12-month target prices predicted by analysts. The findings reveal that the iShares Dow Jones U.S. ETF (Symbol: IYY) has an implied analyst target price of $164.42 per unit.

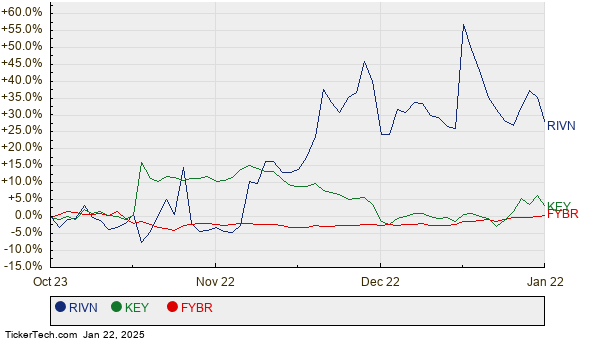

Currently, IYY is trading around $147.55 per unit. This suggests that analysts anticipate an upside potential of 11.43% based on their projections for the ETF’s underlying assets. Among the holdings with significant upside potential are Rivian Automotive Inc (Symbol: RIVN), KeyCorp (Symbol: KEY), and Frontier Communications Parent Inc (Symbol: FYBR). Rivian, currently priced at $13.29 per share, has an average analyst target of $15.29, indicating a possible increase of 15.06%. For KeyCorp, trading at $17.64, analysts foresee a rise to $20.11, which equates to a 14.01% upswing. Furthermore, Frontier Communications is expected to reach a target price of $40.44, which reflects a 13.16% increase from its current price of $35.74. Take a look at the 12-month price history for RIVN, KEY, and FYBR below:

Here’s a detailed summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Dow Jones U.S. ETF | IYY | $147.55 | $164.42 | 11.43% |

| Rivian Automotive Inc | RIVN | $13.29 | $15.29 | 15.06% |

| KeyCorp | KEY | $17.64 | $20.11 | 14.01% |

| Frontier Communications Parent Inc | FYBR | $35.74 | $40.44 | 13.16% |

Investors may wonder if analysts have justifiable reasons for their target prices, or if they might be overly optimistic about future stock performance. A high target in comparison to current trading prices can signal a positive outlook but risks adjustments if those targets fail to account for recent developments in the industry. Such considerations merit further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding JRJR

• Top Ten Hedge Funds Holding COHU

• OPI Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.