Analysts See Potential Gains in SPDR Portfolio S&P 500 ETF (SPLG)

Recent evaluations reveal that the SPDR Portfolio S&P 500 ETF (Symbol: SPLG) is trading below its expected target price, hinting at potential growth opportunities for investors.

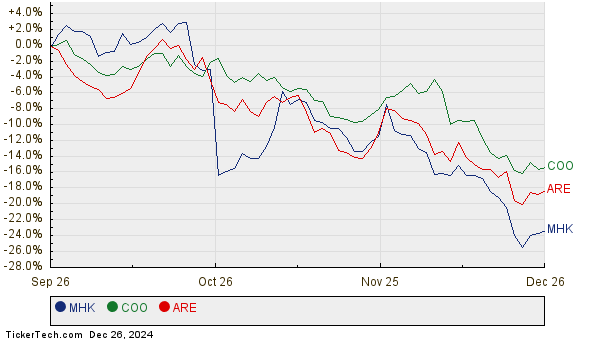

According to our analysis at ETF Channel, the implied analyst target price for SPLG is $78.60 per unit, based on the average target of its underlying holdings. Currently, SPLG trades at approximately $70.94, suggesting analysts anticipate a 10.80% upside from this price. Noteworthy individual stocks within SPLG that show strong potential include Mohawk Industries, Inc. (Symbol: MHK), Cooper Companies, Inc. (Symbol: COO), and Alexandria Real Estate Equities Inc (Symbol: ARE). While MHK has a recent trading price of $120.19 per share, the average analyst target is $157.69, indicating a, 31.20% upswing. Similarly, COO has a recent price of $92.81, but analysts project a target of $116.69, showing a potential upside of 25.73%. Finally, ARE is expected to reach a target of $120.54 per share, 21.22% higher than its recent trading price of $99.44. Below is a chart depicting the price performance of MHK, COO, and ARE over the past year:

Here’s a summary of the analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 500 ETF | SPLG | $70.94 | $78.60 | 10.80% |

| Mohawk Industries, Inc. | MHK | $120.19 | $157.69 | 31.20% |

| Cooper Companies, Inc. | COO | $92.81 | $116.69 | 25.73% |

| Alexandria Real Estate Equities Inc | ARE | $99.44 | $120.54 | 21.22% |

Are analysts optimistic about these projections, or could they be out of touch with current trends? High price targets can indicate confidence in future performance, but they may also lead to downgrades if market conditions shift. Investors should conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Dividends

• ETFs Holding CBPO

• STRE shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.