Analysts Predict Upside for Invesco S&P SmallCap Momentum ETF

In a recent analysis of ETFs, we evaluated the Invesco S&P SmallCap Momentum ETF (Symbol: XSMO) and its underlying holdings. By comparing the trading prices of these holdings against average analyst 12-month target prices, we calculated the ETF’s implied target price at $76.06 per unit.

Current Trading Status and Potential Growth

Currently, XSMO is trading around $67.96 per unit. This represents an 11.92% potential increase based on analyst targets for the underlying stocks. Three particular holdings within XSMO display considerable upside potential: Veeco Instruments Inc (Symbol: VECO), Tanger Inc (Symbol: SKT), and ePlus Inc (Symbol: PLUS).

Noteworthy Stock Performances

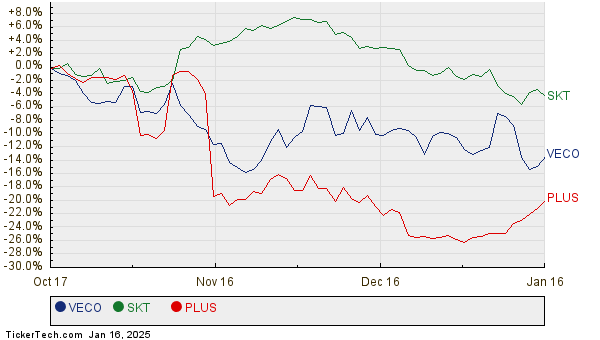

Veeco Instruments Inc, recently priced at $26.78 per share, has an analyst target of $37.86, indicating a 41.36% upside. Similarly, Tanger Inc is trading at $32.95, with potential to rise by 12.67% to meet its target of $37.12. ePlus Inc’s stock is at $79.44, with analysts expecting it to reach $89.50, translating to a 12.66% increase. Below is a chart that highlights the price performance of VECO, SKT, and PLUS over the past twelve months:

Summary of Analyst Predictions

The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P SmallCap Momentum ETF | XSMO | $67.96 | $76.06 | 11.92% |

| Veeco Instruments Inc | VECO | $26.78 | $37.86 | 41.36% |

| Tanger Inc | SKT | $32.95 | $37.12 | 12.67% |

| ePlus Inc | PLUS | $79.44 | $89.50 | 12.66% |

Critical Reflection on Analyst Targets

Are analysts justified in their predictions, or perhaps overly optimistic about these stocks’ performance over the next year? It is crucial for investors to assess the validity of these targets in light of recent company developments. While a high target price can signal optimism, it may also lead to potential downgrades if those targets no longer align with current market conditions. Investors are encouraged to conduct further research to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of AXON

• Funds Holding GNSS

• Funds Holding ISO

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.