Vanguard Russell 1000 Growth ETF Shows Potential for Gains

Analysts project a significant upside in the Vanguard Russell 1000 Growth ETF (Symbol: VONG), indicating promising returns based on current trading prices versus analyst targets.

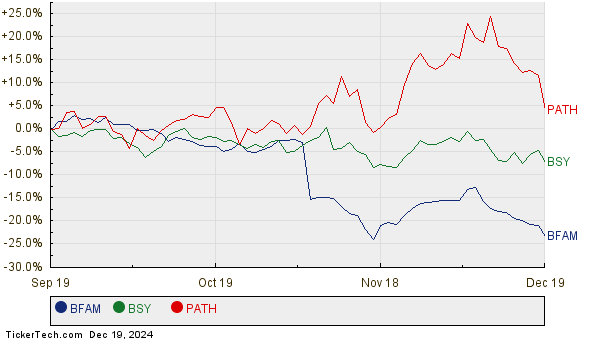

Recent analysis of VONG indicates an implied price target of $116.78 per unit, compared to its recent trading price of $103.79 per unit. This suggests analysts foresee a 12.51% increase over the next 12 months, as based on the average target prices of VONG’s underlying holdings. Noteworthy holdings with substantial upside potential include Bright Horizons Family Solutions, Inc (Symbol: BFAM), Bentley Systems Inc (Symbol: BSY), and UiPath Inc (Symbol: PATH). At a recent price of $105.03 per share, BFAM has an average analyst target of $139.90, representing an upside of 33.20%. BSY, trading at $47.18, has a target price of $60.00, translating to a 27.17% increase. Meanwhile, PATH’s current price of $12.97 suggests a 19.51% upside from a target of $15.50. Below is a chart showcasing the price performance of BFAM, BSY, and PATH over the past year:

Here’s a summary of the analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Growth ETF | VONG | $103.79 | $116.78 | 12.51% |

| Bright Horizons Family Solutions, Inc | BFAM | $105.03 | $139.90 | 33.20% |

| Bentley Systems Inc | BSY | $47.18 | $60.00 | 27.17% |

| UiPath Inc | PATH | $12.97 | $15.50 | 19.51% |

These projections raise questions about whether analysts are being realistic or overly optimistic at this stage. Additionally, it’s important to consider if their price targets account for recent developments in the companies and their respective industries. A high target relative to a stock’s price can signify optimism, but this may also lead to potential downgrades if targets are outdated. Investors are encouraged to conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding GXC

• Agilent Technologies shares outstanding history

• ETFs Holding WETF

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.