Fidelity MSCI Real Estate ETF Analysts Predict Significant Upside

In our analysis of ETFs at ETF Channel, we evaluated the trading prices of each holding compared to the average analyst 12-month forward target price. For the Fidelity MSCI Real Estate Index ETF (Symbol: FREL), the implied analyst target price based on its underlying holdings stands at $30.81 per unit.

Currently, FREL is trading around $27.19 per unit, indicating a potential 13.30% upside based on analysts’ targets for its underlying holdings. Notably, three of FREL’s holdings suggest significant upside: Alexander & Baldwin Inc (Symbol: ALEX), Elme Communities (Symbol: ELME), and NetSTREIT Corp (Symbol: NTST). ALEX is priced at $17.75 per share, yet analysts forecast an average target of $21.00, representing an 18.31% upside. Similarly, ELME, trading at $16.10, has an average target of $19.00, translating to an 18.01% increase. Lastly, NTST, currently priced at $15.80, is expected to reach an analyst target of $18.11, marking a 14.60% upside.

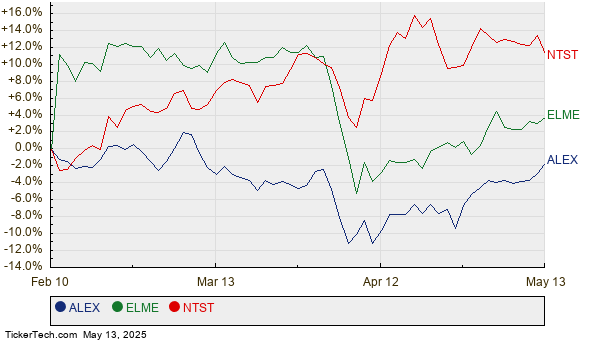

Below, a twelve-month price history chart showcases the stock performance of ALEX, ELME, and NTST:

Here is a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Real Estate Index ETF | FREL | $27.19 | $30.81 | 13.30% |

| Alexander & Baldwin Inc | ALEX | $17.75 | $21.00 | 18.31% |

| Elme Communities | ELME | $16.10 | $19.00 | 18.01% |

| NetSTREIT Corp | NTST | $15.80 | $18.11 | 14.60% |

Analysts’ targets raise questions about their accuracy. Are these projections justified, or might they be overly optimistic? Investors should consider whether recent developments in the companies or the overall market context support these expectations. A high target relative to a stock’s trading price can reflect positive sentiment but may also lead to potential downgrades if the targets do not align with current realities. Investors are advised to conduct further research to assess the viability of these forecasts.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Energy Stock Channel

• Institutional Holders of OLMA

• AUO Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.