Small-Cap ETF IJT Shows Analyst Optimism with Significant Upside Potential

In a recent analysis by ETF Channel, the iShares S&P Small-Cap 600 Growth ETF (Symbol: IJT) reveals promising upside potential based on its underlying holdings. The calculated implied analyst target price for IJT stands at $160.14 per unit.

Strong Potential Upside for IJT

Currently trading near $142.28 per unit, analysts project a 12.55% increase for this ETF based on their average 12-month target prices. Notably, three of IJT’s top holdings show significant upside potential. XPEL Inc (Symbol: XPEL) is currently priced at $42.51 per share, with analysts forecasting a 29.38% increase to an average target price of $55.00. Similarly, American Assets Trust Inc (Symbol: AAT) has a recent price of $22.42, suggesting a 15.97% upside potential towards a target of $26.00. HCI Group Inc (Symbol: HCI) also shows promise, with a target price of $141.25, reflecting a 14.24% increase from its recent price of $123.64.

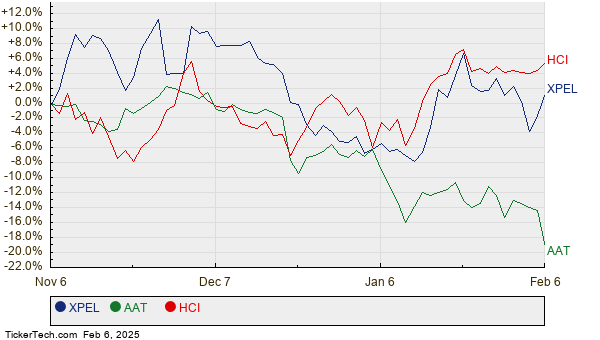

Comparative Stock Performance Chart

Below is a twelve-month price history chart for XPEL, AAT, and HCI:

Summary Table of Current Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares S&P Small-Cap 600 Growth ETF | IJT | $142.28 | $160.14 | 12.55% |

| XPEL Inc | XPEL | $42.51 | $55.00 | 29.38% |

| American Assets Trust Inc | AAT | $22.42 | $26.00 | 15.97% |

| HCI Group Inc | HCI | $123.64 | $141.25 | 14.24% |

Considering the Analyst Targets

The ambitious targets set by analysts prompt further investigation. Are they justified, or is there an element of over-optimism? A high target price can indicate expected growth but could also lead to downward adjustments if recent developments are ignored. Investors should conduct their own research to assess the viability of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• IHD Videos

• Institutional Holders of THCX

• INCO Historical Stock Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.