Analyzing Analyst Targets for iShares Morningstar U.S. Equity ETF: What Lies Ahead?

At ETF Channel, we have analyzed the underlying holdings of various ETFs. By comparing the trading price of each holding to the average analyst 12-month forward target price, we calculated the weighted average implied target price for the ETFs. For the iShares Morningstar U.S. Equity ETF (Symbol: ILCB), the calculated target price is $92.00 per unit.

Current Pricing and Growth Potential

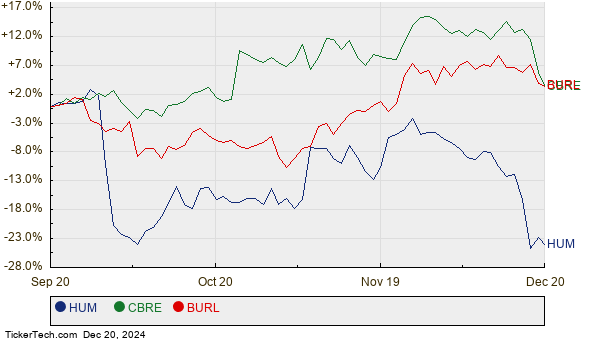

Currently, ILCB trades at approximately $80.97 per unit. This pricing indicates that analysts project a potential upside of 13.62% based on their targets for the underlying holdings. Among those holdings, Humana Inc. (Symbol: HUM), CBRE Group Inc (Symbol: CBRE), and Burlington Stores Inc (Symbol: BURL) stand out due to their significant upside potential. For instance, Humana has a current price of $235.78/share, but the average analyst target is 28.39% higher at $302.73/share. Similarly, CBRE’s recent price of $125.65 shows a 15.80% upside if it reaches an average target of $145.50/share. Burlington is also anticipated to reach a target of $324.39/share, reflecting a 15.39% increase from its current price of $281.12. Below, you will find a twelve-month price history chart for HUM, CBRE, and BURL:

Summary of Analyst Targets

The following table summarizes the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar U.S. Equity ETF | ILCB | $80.97 | $92.00 | 13.62% |

| Humana Inc. | HUM | $235.78 | $302.73 | 28.39% |

| CBRE Group Inc | CBRE | $125.65 | $145.50 | 15.80% |

| Burlington Stores Inc | BURL | $281.12 | $324.39 | 15.39% |

Investors: Analyze with Caution

Are the analysts’ targets justified, or might they be overly hopeful regarding these stocks’ future valuations? Investors need to assess whether analysts are keeping pace with recent developments within these companies and their respective industries. A high target price compared to the current trading price often indicates optimism, but it could also signal potential downgrades if the targets no longer align with current realities. Investors should conduct thorough research to form their own conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Stocks Held By Jeremy Grantham

• Institutional Holders of CHR

• UDR YTD Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.