Analyst Targets Suggest Future Growth for iShares Russell Mid-Cap Value ETF

ETF Channel has assessed the ETFs in our coverage to compare the trading prices of their underlying holdings against predicted analyst target prices. For the iShares Russell Mid-Cap Value ETF (Symbol: IWS), the analysts have set an implied target price of $151.40 per unit based on its holdings.

Potential for Upside in iShares Russell Mid-Cap Value ETF

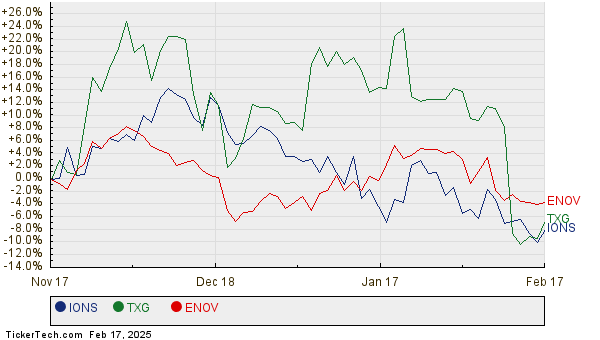

Currently, IWS is trading around $132.75 per unit, indicating a potential upside of 14.05% based on the average analyst targets of its underlying assets. Notably, three holdings within IWS show significant potential for growth: Ionis Pharmaceuticals Inc (Symbol: IONS), 10x Genomics Inc (Symbol: TXG), and Enovis Corp (Symbol: ENOV).

Ionis Pharmaceuticals, trading recently at $31.04 per share, has an impressive analyst target of $60.15, reflecting an upside of 93.78%. Similarly, 10x Genomics, priced at $12.31, has a target estimate of $20.07, indicating a potential 62.98% increase. Enovis Corp, with a recent trading price of $43.89, has a target price of $66.50, which represents a 51.52% potential upside.

The following chart illustrates the performance over the past twelve months for IONS, TXG, and ENOV:

Current Analyst Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell Mid-Cap Value ETF | IWS | $132.75 | $151.40 | 14.05% |

| Ionis Pharmaceuticals Inc | IONS | $31.04 | $60.15 | 93.78% |

| 10x Genomics Inc | TXG | $12.31 | $20.07 | 62.98% |

| Enovis Corp | ENOV | $43.89 | $66.50 | 51.52% |

Considerations for Investors

Are these targets justified, or do they reflect excessive optimism about the future? It’s important for investors to consider whether analysts are basing their forecasts on solid reasoning or outdated trends. While a high price target indicates positive expectations, it may also lead to downward adjustments if market conditions change significantly. Such questions highlight the need for thorough research as investors navigate their decisions.

![]() Explore 10 ETFs With Most Upside To Analyst Targets »

Explore 10 ETFs With Most Upside To Analyst Targets »

Also see:

Technology Stocks Hedge Funds Are Buying

QPAC Historical Stock Prices

WTRH YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.