Analysts Anticipate Growth for Vanguard Large-Cap ETF, Highlight Key Holdings

In our latest analysis at ETF Channel, we examined the underlying holdings of various ETFs. Specifically, we calculated the trading price of each holding against the average analyst’s 12-month forward target price. For the Vanguard Large-Cap ETF (Symbol: VV), our findings indicate an implied analyst target price of $309.08 per unit.

Potential Gains for Vanguard Large-Cap ETF

Currently, the VV ETF trades at approximately $271.94 per unit. This suggests analysts foresee a potential upside of 13.66% for the ETF, based on the average targets for its underlying holdings. Notably, three major holdings that show significant upside potential are Chevron Corporation (Symbol: CVX), Kimberly-Clark Corp. (Symbol: KMB), and McKesson Corp (Symbol: MCK). For instance, CVX trades at $150.30 per share, while analysts project a target price 16.98% higher at $175.82. KMB also shows promising growth, trading at $126.77 with an analyst target price of $148.22, reflecting a 16.92% upside. Similarly, MCK is expected to rise to a price of $671.53, which is 13.77% above its current $590.26 per share.

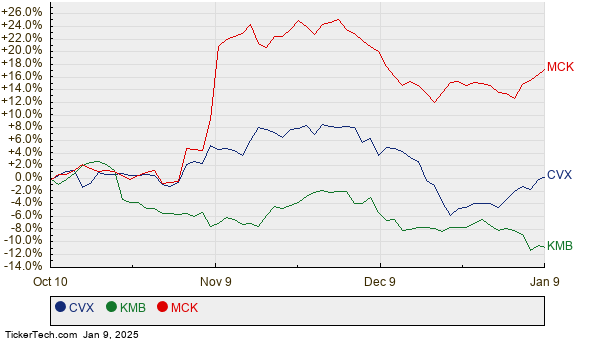

Recent Performance Comparison

Below is a chart comparing the stock performance of CVX, KMB, and MCK over the past twelve months:

Current Analyst Target Price Summary

The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Large-Cap ETF | VV | $271.94 | $309.08 | 13.66% |

| Chevron Corporation | CVX | $150.30 | $175.82 | 16.98% |

| Kimberly-Clark Corp. | KMB | $126.77 | $148.22 | 16.92% |

| McKesson Corp | MCK | $590.26 | $671.53 | 13.77% |

A Closer Look at Analyst Targets

Are these analyst targets realistic, or are they overly optimistic regarding the future prices of these stocks? Investors should consider whether analysts possess valid reasons for their predictions or if they may have missed recent changes in the market landscape. This is particularly important, as a high target relative to a stock’s current price often reflects optimism but can also lead to future downgrades. Thorough research will help investors make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Top High Dividend Yield Stocks

JAQC Videos

Funds Holding NMHI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.