Analysts Eye Growth in Fidelity Small-Mid Multifactor ETF and Key Holdings

ETF Channel has closely analyzed the underlying assets of various ETFs, particularly focusing on the Fidelity Small-Mid Multifactor ETF (Symbol: FSMD). By examining the trading prices of these holdings against the projected 12-month target prices from analysts, we have determined the weighted average implied target price for FSMD, which stands at $48.72 per unit.

Current Trading Price Suggests Potential Growth

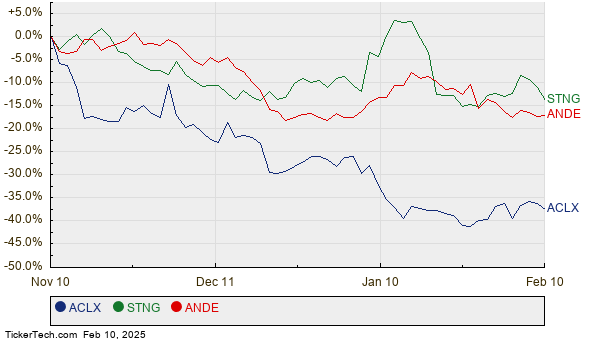

As FSMD currently trades at around $42.44 per unit, analysts anticipate a substantial upside of 14.80%. Several underlying stocks significantly contribute to this optimism. Noteworthy examples include Arcellx Inc (Symbol: ACLX), Scorpio Tankers Inc (Symbol: STNG), and Andersons Inc (Symbol: ANDE). For instance, although ACLX has a recent trading price of $66.91 per share, analysts project it could rise by 72.81% to an average target of $115.62 per share. STNG and ANDE also illustrate healthy growth expectations, with target prices forecasting increases of 70.74% and 54.89%, respectively, from their current trading values.

Below is a twelve-month price performance comparison for ACLX, STNG, and ANDE:

Detailed Analyst Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Small-Mid Multifactor ETF | FSMD | $42.44 | $48.72 | 14.80% |

| Arcellx Inc | ACLX | $66.91 | $115.62 | 72.81% |

| Scorpio Tankers Inc | STNG | $47.09 | $80.40 | 70.74% |

| Andersons Inc | ANDE | $40.35 | $62.50 | 54.89% |

Are Analysts’ Predictions Realistic?

The optimism reflected in these analyst target prices raises an important question: are their expectations grounded in reality? It’s crucial for investors to evaluate whether these targets are based on sound reasoning or if they could be overly optimistic, potentially leading to downgrades in the future. Analysts may also need to adapt their predictions based on new developments within these companies or industry-wide shifts.

![]() Explore 10 ETFs With Most Upside To Analyst Targets »

Explore 10 ETFs With Most Upside To Analyst Targets »

Also see:

• AMETEK RSI

• ZETA shares outstanding history

• NLTX Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.