Analysts See Upside Potential in John Hancock Multifactor Mid Cap ETF

Analyzing the ETF landscape, we evaluated the John Hancock Multifactor Mid Cap ETF (Symbol: JHMM) for its growth prospects. According to our findings at ETF Channel, the implied analyst target price for JHMM stands at $69.35 per unit.

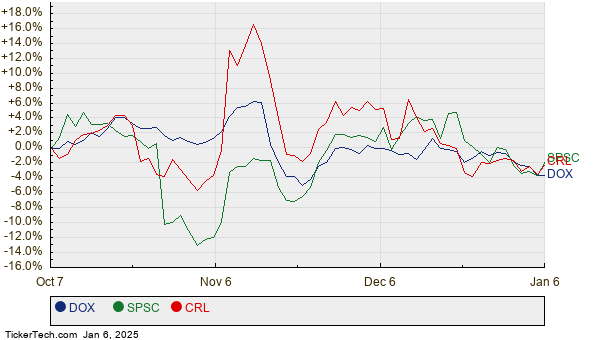

Currently priced around $60.32 per unit, this indicates analysts foresee a potential upside of 14.97% for this ETF based on the target prices from its underlying holdings. Among JHMM’s key holdings, three stocks stand out for their upside potential: Amdocs Ltd. (Symbol: DOX), SPS Commerce, Inc. (Symbol: SPSC), and Charles River Laboratories International Inc. (Symbol: CRL). Notably, DOX is priced at $84.17/share, while analysts predict a target of $100.86/share, suggesting a significant upside of 19.83%. Similarly, SPSC, trading at $186.85, has a target price of $223.70/share, equating to a 19.72% increase. Lastly, CRL, currently at $185.80, has an expected target of $213.73/share, representing a 15.03% upside. Below is a twelve-month price history chart for DOX, SPSC, and CRL:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| John Hancock Multifactor Mid Cap ETF | JHMM | $60.32 | $69.35 | 14.97% |

| Amdocs Ltd. | DOX | $84.17 | $100.86 | 19.83% |

| SPS Commerce, Inc. | SPSC | $186.85 | $223.70 | 19.72% |

| Charles River Laboratories International Inc. | CRL | $185.80 | $213.73 | 15.03% |

We ask: Are analysts too optimistic with these targets or do they have legitimate reasons? It’s essential to consider whether their projections align with current industry trends and company performance. A high target price relative to its trading value may suggest confidence, but it could also foreshadow potential downgrades if outdated assumptions are driving those numbers. Investors are encouraged to conduct further research before making any decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Insights:

• Super Micro Computer DMA

• PSTG Videos

• Institutional Holders of RALY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.